How to Buy a House Before Selling Your Home

Ready to buy a home? If so, things can get a little complicated if you aren't a first-time buyer. After all, first-time buyers have the luxury of taking their time shopping for a home; when the right one comes along, they also don't have to worry about selling an existing home before they make an offer.

If you're a current homeowner and are ready to relocate, there are some logistical and financial obstacles you'll need to overcome. For starters, you'll need to decide whether you'll sell your current home before you make an offer on a new one—or if you'll take your chances buying before you sell.

In today's market, more buyers are actually buying new homes before they sell off their existing ones. After all, the real estate market is extremely competitive and there are other benefits to buying before you sell. Not everyone can qualify for a home loan without pulling the equity out of their current residence. This is when you'll need to seek out both expert Real Estate Agents and mortgage lenders to find what options are available to you.

If you're thinking about purchasing a new home prior to listing your current one, it can be done. However, there are some things you should know before you get started.

Reasons to Buy Before You Sell

So, why would you want to commit to buying another home before you sell your current one? There are a few reasons this is becoming such a popular option in today's real estate market.

You Don't Want to Miss Out

For starters, consider a basic matter of supply and demand. There's a lot of demand for houses right now and not a lot of inventory, which means that buying is extremely competitive. If you have to wait to buy your next home until you sell your current home, you might end up missing out on your dream home to another buyer. At the same time, the seller's market means that your own home will probably sell quickly—giving you a little more peace of mind when you make an offer.

You've Found an Amazing Deal

Likewise, you might choose to buy a home before you sell your existing home if you've found a deal that's too good to pass up. Perhaps you've found a foreclosure property or even a short sale that you want to take advantage of; you'll still need to act quickly in order to secure the deal, which means you probably won't have time to wait for your existing home to sell and close.

Potential Challenges to Consider

Of course, buying a new home before you sell your existing one comes with some inherent logistical challenges that can create a lot of stress. These obstacles should not be overlooked when planning out your next home purchase.

Coming Up With a Down Payment

Unless you can qualify for a home loan that doesn't require a down payment (such as a VA loan), you're going to need to come up with a substantial sum of money to put down on your new home. A lot of times, buyers rely on proceeds from selling their existing home to cover these expenses (as well as closing costs and other fees). When you choose to buy before you sell, however, you'll need to come up with this money up-front instead.

Depending on the type of financing you'll be using to buy your new home, you might have to come up with as much as 20% of the purchase price as a down payment. It doesn't take a math whiz to figure out that this can add up to be a lot of money out of your own pocket.

Potentially Carrying Two Mortgages

Meanwhile, even if you time things well and sell your existing home very shortly after you buy your new home, there's still a good chance that you'll be carrying two mortgages for a short period of time. This will be the case unless the closing date on your current home ends up falling on or before the closing date on your new home, which is unlikely.

Carrying two mortgages (even for a short period of time) can be stressful and, of course, a large financial burden. Depending on your debt-to-income ratio, it may be difficult to get approved for a second mortgage as well.

Logistical Stressors

Buying a new home before selling your existing home can be stressful not just financially, but logistically as well. Arranging to show your home to potential buyers while you're also in the process of packing up your belongings can be challenging. Likewise, arranging for utilities and other services to be transferred between properties comes with its own difficulties.

Tips for Buying Before You Sell

If you've decided to buy a new home before selling after weighing the pros and cons, you may be wondering what steps you can take to make the process a little easier on yourself. There are a few tips to consider that can make the process of buying and selling less stressful.

Talk to a Real Estate Agent

Always start by consulting with a real estate professional before you make any serious moves towards buying a new house or selling yours. It's a good idea to schedule an appointment to have your current home evaluated by a real estate agent as one of your first steps. From there, your agent will be able to give you a better idea as to how quickly he or she thinks your home would sell and for how much.

A real estate agent will also be able to provide you with some personalized feedback on steps you can take to make selling your home easier and faster when the time comes. He or she may recommend, for example, making some minor repairs or upgrades to your home now so that it flies off the market when you list it.

Explore Down Payment Options

If you know that coming up with a down payment on a second home will be challenging for you, start exploring your options now. See if you might qualify for a mortgage that does not require a down payment, such as a VA loan or USDA loan.

If you don't qualify for either of these types of loans, there are still ways to come up with the money you need for a down payment. Some buyers, for example, will borrow money from a retirement fund or even take out a home equity line of credit (HELOC). A cash-out refinance on your current property is also a viable option to consider.

Consider Making a Contingent Offer

If finances are going to make carrying two mortgages at the same time difficult for you, remember that you always have the option of making a contingent offer on your new home. This means that the offer you make is dependent on you being able to sell your current home, which can give you some added peace of mind that you won't be stuck with two mortgages.

While contingent offers can make your life easier, it's important to understand that contingent offers aren't extremely appealing to sellers (think about how you would feel if you received a contingent offer versus a non-contingent one). With this in mind, contingencies are only recommended in situations where you absolutely cannot afford to carry two mortgages.

Get Your Home Sale-Ready

Don't wait until after you've closed on your new home to start preparing your existing house for the market. Ideally, you'll want to start getting your home ready to sell as soon as possible. This means taking the time to make any necessary repairs to your home, as well as tackling some upgrades that could add resale value and appeal to prospective buyers.

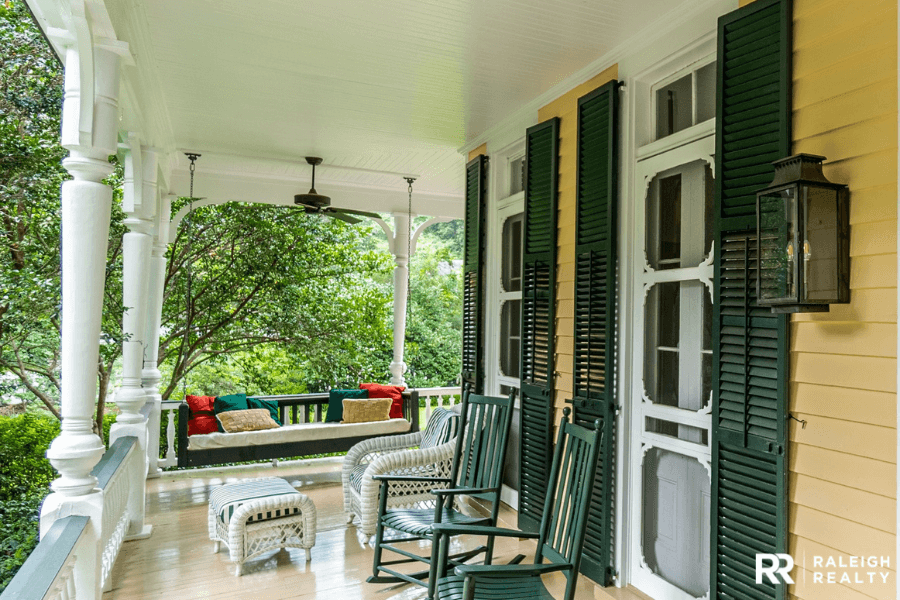

When getting your home ready to list, focus on curb appeal by doing things like:

- updating your landscaping

- power-washing or painting your home's exterior

- painting your front door

You might also want to consider paying to have your home professionally staged, especially if you've already moved your furniture into your new home. Staging can help potential buyers envision themselves living in your home more easily and may improve your resale value as well.

Choose the Right Financing Option

Last but not least, make sure to explore your financing options and select a mortgage type that you'll be comfortable with. Don't assume that just because you used a certain type of mortgage to buy the existing home that you have to use the same type of financing on your new home. Furthermore, make sure your lender is clear if you will be carrying two mortgages at once so you can be aware of any income or debt-to-income ratio requirements that may be in place.

The Bottom Line

While buying a new home before selling your current home can pose some unique challenges, the reality is that people do it all the time. With the right representation and guidance from an experienced real estate agent and a little planning on your part, you'll be well on your way to a successful home purchase and sale! From there, you can settle into your new space with confidence and peace of mind.

#cta-homes-for-sale#