7 Things To Know About Buying a Foreclosed Home

Are you considering buying a foreclosed home? Here are seven important things to know about buying a foreclosed home.

Buying a new home is an exciting yet stressful endeavor, and there will be many things to think about. This process might be more extensive if you are considering buying a foreclosed home.

Whether you are a first-time home buyer or a seasoned pro, buying a foreclosed home is a bit different. According to the North Carolina Judicial Branch, foreclosure is a method of enforcing payment of a debt secured by a mortgage, deed of trust, or lien on real property by selling the property and applying the proceeds of the sale to satisfy the debt. In other words, a home is at risk of being foreclosed when the homeowner misses three consecutive payments.

As a homebuyer, you may want to buy a foreclosed home because they are cheaper. However, the majority need many renovations or repairs. Foreclosures are often sold with as-in consideration, meaning you may need to make repairs before they are move-in ready. You shouldn't let this stand in your way; foreclosures may be a great investment for buyers.

Since foreclosures are sold in as-in condition, they may be perfect for you if you have the time and budget to make renovations. Before buying a foreclosed home, there are many things to consider, so here are seven important things you should know.

Keep reading to learn all about buying a foreclosed home.

1. Understand The Types of Foreclosure Purchases

Foreclosure happens when a homeowner defaults on mortgage payments, and the lender sizes and sells the property to make up for the lost payments. In North Carolina, foreclosures follow a non-judicial process; this means no court is involved, and they are heard in front of the county clerk, not a judge. If you are considering buying a foreclosed home, you should be aware of the different types of foreclosure properties.

Foreclosure Auctions

The fastest way to obtain a foreclosed home is at an auction. Home buyers can buy the home for much less than the market value. However, auctions are typically only done with cash payments.

Make sure you bring your cash and initial approval with you if you want the home. When buying at an auction, the only risk is agreeing to buy the home without an appraisal or inspection, meaning you'll have to have this handled once you move in.

Bank-Owned Properties

Many buy a property from a lender's real estate-owned (REO) inventory. In doing this, you won't be working with a homeowner, and the lender typically clears the title beforehand to ensure it is vacant.

These homes are also sold as-is, but you can view the home before and order an inspection. However, most lenders will sell directly to the buyer, so you'll need a real estate agent to help.

Preforeclosures

Another type of foreclosure property is a preforeclosure, which is a property in the early stages of foreclosure. You can look up the multiple listing service (MLS) to find a list of potential preforeclosures. The database lists homes where the homeowner has received a notice of default from their lender.

Even if the home never goes on the market, you could work with the current owner, who may want to sell the property before it forecloses. This would be a win-win situation in that you can buy the home at a lower price, and the homeowner can avoid complete foreclosure.

2. Hire a Real Estate Agent Who Specializes in Foreclosures

Hiring a good real estate agent is essential, no matter the home type you are interested in buying. However, in a foreclosure case, it is best to work with an agent who has experience working with REO agents. This is because most lenders give properties to REO agents who work with traditional real estate agents.

A foreclosure agent will help you search for foreclosures and walk you through your state's REO buying process. This process can be a bit different than the typical home-buying process, so having a professional alongside you will be extremely beneficial.

An expert will be able to assess whether a foreclosed home is worth the potential risks involved, including necessary repairs.

3. Get Preapproved For A Mortgage

Mortgage pre-approval is one of the most important steps in the home-buying process. Finding your dream home only to learn your credit score or income is too low for a mortgage is a frustrating and avoidable experience.

No matter your credit score, lenders will still need to assess your income, down payment funds, and total debt to determine if you qualify for a mortgage. Even though foreclosures are typically cheaper, you should still get preapproved to ensure you get the home you want.

This is especially important if you are buying a home at an auction. Most auctions are cash only and will need the buyer to be preapproved. Save your time and money and get your mortgage preapproved before settling on a home.

4. Establish Your Price Point

Similar to buying a non-foreclosure home, you will need to establish your price point. Establishing your price point will depend on the type of foreclosed home you are planning on buying. If you plan on buying a home that is real estate or government-owned, you or your real estate agent will need to make an offer to the agent working with the bank. Sometimes, you may need to make an offer with the government agency itself.

Buying a foreclosed home from an auction is a bit different. You or your real estate agent will make an offer to the person responsible for the auction. In this case, you aren't talking to any homeowners, but you will still need a price point to gauge how much you want to spend.

In preforeclosures, you will need to make an offer to the homeowner. No matter the type of foreclosed home, you have to work with your real estate agent and establish a contingency plan as part of the offer to ensure a home inspection before the purchase is finalized. There are many common home inspection issues to know about to ensure you are getting the best deal.

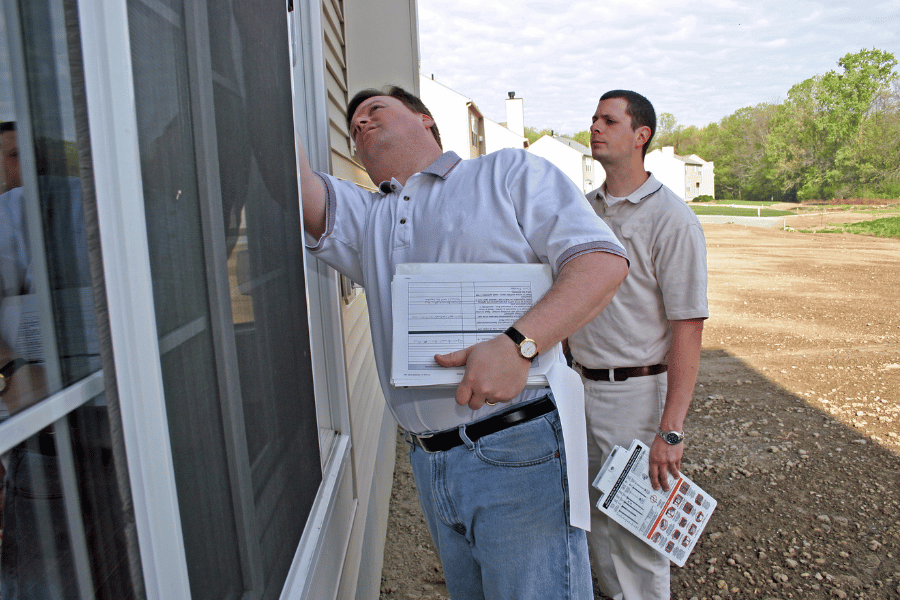

5. Obtain An Appraisal and Inspection

Anytime you are buying a new home, you will need to obtain an appraisal and inspection. However, buying a foreclosed home looks a little different. The majority of the time, you are buying a foreclosed home as-is. This means you should prepare for the home to need repairs and renovations.

The inspection will give you a detailed report of the repairs needed and any potential problems with the home's foundation or overall structure. After an inspection, you'll have an estimated cost of the repairs, which you can look over to decide if they are worth the price.

In North Carolina, the buyer typically pays for the home inspections. A home inspection can range anywhere from $300 to about $500. After that, you will tackle the repairs, which can be much more expensive. However, foreclosed homes may have more issues than non-foreclosed homes.

Note that if you are buying a foreclosed home at an auction, you are buying the home before the inspection, so weigh your options carefully. You can also buy a short-sale home, which is similar to a foreclosed home, but you can get an inspection before closing.

6. Pros of Buying a Foreclosed Home

Buying a foreclosed home has its pros and cons. While the conditions associated with purchasing a foreclosed home vary depending on the type of foreclosed home, the advantages and disadvantages are fairly similar.

You may be able to buy the property for less than the market price.

Typically, banks or loan companies set the asking price below the normal rate because they want to sell the property for the remaining mortgage balance owed by the previous owners. This is undoubtedly one of the biggest advantages of buying a foreclosed home: you can buy your dream home for less than the average price. The extra money you save can be put towards any necessary repairs.

No expenses related to the previous owners.

If you buy a foreclosed home, the title is clean. This means you will not have to pay liens or back taxes from the previous homeowners.

You can complete inspections during the contingency period.

While you may not be able to get an inspection before buying the house, if you find that the disadvantages outweigh the advantages, you may be able to back out of the purchase.

7. Cons of Buying a Foreclosed Home

Like any big decision, buying a foreclosed home has pros and cons. Here are a couple of critical pros to consider.

Banks are unlikely to negotiate.

Depending on the situation, banks are less likely to negotiate on the selling price of the home. Again, this is because the selling price will reflect the remaining mortgage balance from the previous owners.

Undesirable Locations

Foreclosed homes are sometimes in less-than-desirable locations. This may be a deal breaker for many home buyers, as location is one of the most important things to consider when buying a home. On the other hand, foreclosed homes in nice areas usually sell fast. Make sure to check the listing daily.

Repairs

Foreclosed homes can be in excellent condition or the exact opposite. Some foreclosed homes have been vacant for years and are in need of new appliances, updates, repairs, or renovations. These extra costs might end up equating to how much you would spend on a non-foreclosed home. A home inspection will help you determine whether this home is worth it.

Methodology

We used information and data from several different sources, as well as our own data, to determine everything you need to know about buying a foreclosed home. Most of the data was sourced from the following sources:

FAQ: Buying a Foreclosed Home

Here are some commonly asked questions about buying a foreclosed home.

How do I get a free list of foreclosures in my area?

Many real estate websites have lists of the foreclosures in your area, including Zillow and Realtor.com. If you live in the Triangle, you can go to the Wake County Website to see all the foreclosures in the county. You should also talk with a trusted real estate agent who will know all the foreclosures in your area.

How do you buy foreclosure homes in North Carolina?

Buying a foreclosed home in North Carolina is similar to buying any other home in the state. You will still need to be preapproved, find the home, tour, submit offers, obtain an appraisal, and close on the home.

How long do foreclosures take in NC?

In North Carolina, the foreclosure process takes about 120 days, from the date the first payment is missed to when the property is sold at a foreclosure sale. This may vary depending on several factors, like the lender's policies and procedures.

How many missed payments before foreclosure in North Carolina?

A homeowner must miss three consecutive mortgage payments for the foreclosure process in North Carolina to begin. Next, the first step in the legal process begins when the lender sends a notice of default to the homeowner.

Can you stop a foreclosure in NC?

Under North Carolina law, a homeowner can stop a foreclosure with a bankruptcy filing option, the expiration of the upset bid period. In other words, the sale data plus ten days or another ten days after the final upset bid is submitted at the courthouse.

Buying a Foreclosed Home - The Bottom Line

While you decide whether buying a foreclosed home is the best decision for you, remember that competitively priced foreclosed homes typically sell quickly. This means cash buyers are usually in a better position for a successful purchase.

Similar to looking at comparative homes, research recent sales of non-foreclosed homes to ensure you are getting a bargain. Also, evaluate your budget before buying a foreclosed home because you may need extra funds for any renovations or repairs.

The Triangle is full of many foreclosed and non-foreclosed homes where amenities and local favorites will surround your family. Whether you are searching for a single-family home, townhome, condominium, or apartment complex, you are bound to find the best home in Raleigh for you and your family.

Before you buy your next home in the Triangle, feel free to contact one of our helpful real estate specialists, as they are eager to help you find the perfect home. We know that buying a home can be overwhelming, so make sure you are prepared beforehand.