How Long Does An Appraisal Take?

Appraisals are important in home buying and selling, but how long do they take? Follow along to learn about the process of an appraisal, the time frame, and more!

If you're buying or selling a home, you may have an appraisal scheduled. An appraisal assesses the fair market value of a property, business, antique, or collectible. For now, we will focus on appraisals within the home-buying process. Appraisals are essential before buying a house so that you know how much the house is worth and can make smart financial moves.

The appraisal process can be overwhelming, so let's break it down!

The purpose of an appraisal

An appraisal will provide you, your lender, and anyone else in the transaction with useful information about the home. It will show you how the property compares to others and describe exactly what makes it valuable.

Your lender may also require you to have an appraisal done and ask you to take care of the costs. When the appraiser determines the fair market value, it helps assure the lender that the price of the home is fair. Fair market value (FMV) is the price a property will sell for in an open market. Once your appraisal is done, you will receive a copy of the appraisal and opinions of value no later than three days before closing.

An appraisal can help you from paying too much for a house that's worth far less. In your home offer, your agent may request an appraisal contingency. This essentially allows you to back out of the sales contract if the appraisal comes in too low to justify the purchase price. If you're purchasing a house with cash, an appraisal is completely up to you. While it's not required, we recommend doing one to ensure you're not paying overprice.

How long does an appraisal take?

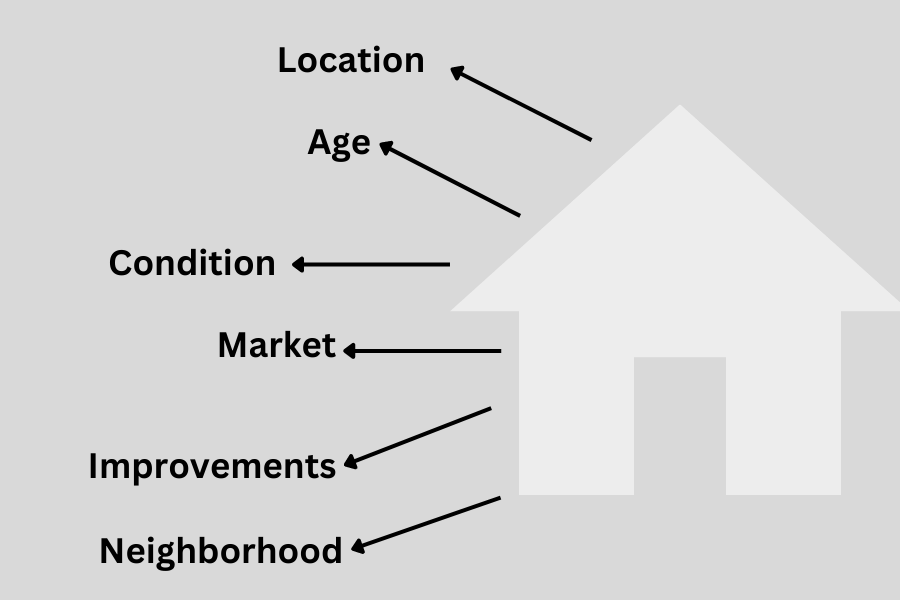

Unlike an inspection, where they are looking for any defects in the home, an appraiser is looking at the overall value and condition of the home. To complete their report, appraisers will look at the home's overall condition, any upgrades or improvements made to the property, and do market research into similar homes to calculate an appraised value. The appraisal will typically take 30 minutes to an hour, but the entire process will typically take anywhere from a few days to a week or more. The process timeline depends on your home size, the appraiser's schedule, and the market. If you apply for an FHA or VA loan, the appraisal will be more strict and precise.

The Appraisal Process

Hiring an appraiser

The first step is hiring an appraiser once you have a house under contract. Your lender will typically recommend a few different appraisers, and you will pick one. They usually cost around $300-$500 but vary based on home size, location, and the appraiser's expertise.

Inspect

After you've selected an appraiser and scheduled a date and time, the appraiser will visit your house for an inspection. He/she will examine the interior and exterior of your home to get a complete picture. They may also ask the sellers about any improvements or projects they should know about. From there, the appraiser will start his/her report, including examining the house, repairs, neighborhood trends, lawn condition, quality, and size.

Interior Inspection

According to PropertyClub, the interior inspection includes:

- Dimensions

- Number and purpose of rooms (i.e., bedrooms, bathrooms, and kitchens)

- Functional layout and structural integrity

- Included utilities, appliances, and amenities

- Condition of walls, stairs, floors, doors, ceilings

- Health and safety regulations

- Code Compliance

When conducting an appraisal, the home's interior is just as important as the exterior. Appraisers will look at the walls, stairs, floors, doors, ceilings, kitchen appliances, bathrooms, the layout & structural integrity, square footage, major systems (HVAC), materials, and more. When they inspect, they look for signs of water damage and any other pertinent issue that must be addressed.

Exterior Inspection

The Exterior inspection includes:

- Age and location

- Quality of the property's site

- Quality of the construction

- The integrity of the roof and foundation

- Condition of gutters

- Parking and garage

- Exterior paint or siding condition

- Neighborhood

- Porch/patio quality

- Insulation

When focusing on the home's exterior, appraisers are ensuring there aren't any safety hazards, broken pieces/structures, etc. They will also look at the age and location of the home, as well as the size. Most importantly, they will ensure the roof is up-to-date and doesn't need to be repaired or replaced.

Home Comparison

After the home has been inspected, the appraiser will begin looking at comparable homes and verify the city records. The comparable homes must be similar in size, age, and location and must have been recently sold or are currently on the market. Fortunately enough, new software has made comparing homes easy. The appraiser will key in a few data points, and the software will list the relative homes.

The report

The last step in the process is the report. The appraiser will calculate the fair market value and put all relevant information into their report. Not only will it give you information from the inspection and comps, but it will also detail the logic behind the evaluation. Appraiser will use one of three strategies:

Comparison

The most commonly used method is the comparison method, in which appraisers value a property based on comparables and their recent selling prices.

Income approach

aka the "income capitalization approach," estimates the value of the property based on the income it generates. They do this by calculating the net operating income (revenue the property generates minus operating expenses) and dividing it by the capitalization rate - the expected rate of return

Cost Approach

The cost approach examines the property's value compared to the cost of building an equivalent building, including the cost of land and construction expenses.

Writing up the report typically takes one to five days.

Understanding the report

Understanding the appraisal report is crucial in the home buying process as it can affect your mortgage and whether or not you can go through with the sale.

A low appraisal

A low appraisal means the value the appraiser assesses is lower than the agreed-upon purchase price. This is worrisome because it can affect how much your lender will loan you and ruin your closing. Lenders agree on loan terms based on the appraisal. If the appraisal is lower than the purchase price, you may be unable to close on the home due to a lack of funds. According to Fannie Mae, appraisals come in less than 8% of the time.

An appraisal can come back low if the wrong comparables are used. It's essential to ensure that the appraiser chooses homes that are similar in living area, bedroom/bathroom count, location, etc. They can also come back low if significant information is missing from the report. Before panicking, look over the report and make sure everything is correct to the best ability. If you get a low appraisal, consider these options:

- Request another look

- Make up the difference in case

- Re-negotiate the sales price

- Exercise your appraisal contingency and terminate the contract

A high appraisal

As the buyer, a high appraisal is a win-win. It means you have agreed to pay the seller less than the home's actual market value. Your mortgage is not affected, and you can continue with the sale.

How to prepare for an appraisal

There are many steps homeowners can take to prepare themselves and their homes for an appraisal. You'll first want to gather any relevant information about the home. The more information you can give, the more accurate the appraisal.

- Research the current housing market and the sale price of homes similar in the area. This will prepare you for what you should expect to see in your report.

- Give the appraiser proof of any upgrades or improvements you've made to the home, including any additional and major remodeling projects.

- Make minor improvements such as touching up paint, replacing broken windows and doors, etc.

- Spruce up your home's curb appeal. It's the first thing an appraiser sees, and they take into account your home's exterior.

- It's important to "depersonalize" your home for appraisers, potential buyers, agents, etc. It ensures your privacy and safety are kept intact and allows buyers to visualize it as their home.

- Having clean and decluttered spaces make your home more appealing and makes rooms seem larger. It also allows appraisers to take a better look at the house.

- Make sure all of your major systems are working, including water, electricity, heating & cooling, etc.

How can I become an appraiser?

If you're interested in becoming an appraiser, you will need to get licensed or certified!

First, you must take the following classes: Basic Appraisal Principles, Basic Appraisal Procedures, the 15-hour national USPAP course, and the NC Supervisor/trainee course. Once you've completed these courses, you will fill out the application form and fill it out completely and accurately. You must agree to a criminal background check and pay the $200 application fee to submit your application. From there, the board will review anything necessary, and you should hear back within six weeks.

FAQ

What causes a high appraisal?

The local market plays a significant factor in your appraisal. If the market is hot, homes tend to sell at a much higher price.

What negatively affects home appraisals?

The age and condition of the home's systems, such as HVAC, plumbing, and appliances, can negatively affect appraisals.

Why did my appraisal come back low?

An appraisal can come back low for various reasons, including a changing market, an inexperienced appraiser, inaccurate comps, or an inaccurate evaluation.

Can you be present during the appraisal?

Yes, but it's not required or typical. It can be valuable if the appraiser needs information, but do not hinder the appraiser or persuade. Typically, the agent will attend the last 30 minutes of the appraisal and get a verbal report.

What are the three types of appraisals?

Comparison approach, income approach, cost approach.

What do they look at during an appraisal?

Any factors that could affect the property's value.

Appraiser Statistics

- There are over 34,752 real estate appraisers currently employed in the United States.

- 33.5% of all real estate appraisers are women, while 66.5% are men.

- The average age of an unemployed real estate appraiser is 49 years old.

- The most common ethnicity of real estate appraisers is white (81.1%), followed by Hispanic or Latino (6.9%), Black or African American (4.7%), and unknown (3.9%).

- Real estate appraisers are most in demand in Sunnyvale, CA.

- The technology industry is the highest-paying for real estate appraisers

- 8% of all real estate appraisers at LGBT.

How Long Does An Appraisal Take - Final Thoughts

When buying or selling a home, an appraisal is usually already on your to-do list. For sellers, it helps you determine a fair listing price. For buyers, an appraisal helps you avoid paying too much for a home. They are not always required, but they are always recommended. It's beneficial to have an appraisal done as early in the home-buying process as possible. When obtaining a mortgage, you cannot close on your house until the report comes in. Try to get it done early because appraisals can take a week or longer, depending on the market status and the schedule of your chosen appraiser.

If you're interested in moving to the area and would like to start the home-buying process, please feel free to contact us or continue browsing our website for more information.