How to Get a Mortgage in Raleigh

What are the steps involved in obtaining a mortgage?

Chances are, if you are a first-time home buyer, you will most likely need to apply for a mortgage. In addition to finding the right mortgage, it is also important that you find a lender who will provide an interest rate and closing costs that won't break the bank.

Of course, it is difficult to have the perfect combination of all of these factors, but knowing how to obtain a mortgage and understanding your grant eligibility could help you save thousands of dollars in the long term. We outline some of the best strategies for securing a great mortgage deal.

Here is how to obtain a mortgage in Raleigh

1. Find a Lender and Get Pre-Approved for a Mortgage

There is a difference between getting pre-qualified and pre-approved. Pre-qualification does not require a credit check and is simply a way of determining how much you can afford to spend per month on a mortgage to avoid foreclosure and other problems. Pre-qualification is far less time-intensive than pre-approval and is much easier to do. Pre-approval is far more valuable because it involves having a lender run a full credit check and verify your documentation to provide a specific loan amount.

Final loan approval doesn't happen until after the appraisal on the property is complete, and the loan is applied to the property. Obtaining a mortgage pre-approval letter will help you know how much you can afford to spend on a mortgage each month and indicate to sellers that you are serious about buying (and not just shopping around).

Before even attending an open house, it is highly advisable to obtain mortgage pre-approval. If you are unhappy with the lender you use during the pre-approval process, you do not have to use that same lender to obtain your mortgage.

Have the following items ready to go before meeting with a lender for mortgage pre-approval:

-

Pay stubs from the last 30-60 days

-

Federal tax returns from the past two years

-

W-2 forms from your employer from the past two years

-

Proof of funds for a down payment (i.e., a bank account statement)

-

Statements from your checking, savings, and investment accounts from the past 60 days

-

Landlord's contact information (if you rented) from the past two years

-

Real estate holding information, if applicable

-

If the down payment is a gift from a family member, a letter will need to be provided stating the money is a gift and not a loan

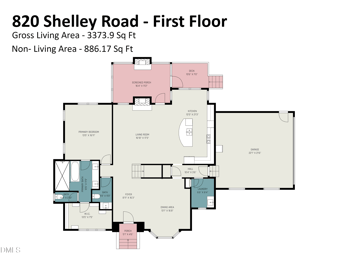

2. Find the Home you Wish to Buy and Complete the Appraisal

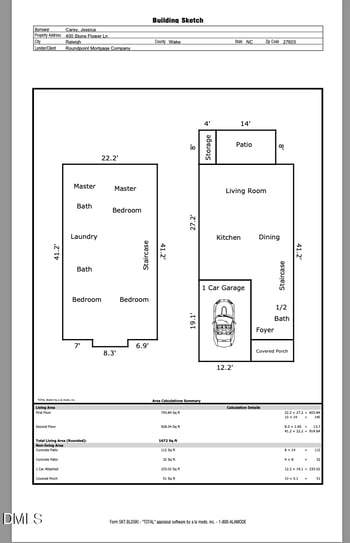

The home appraisal is the lender's way of assessing the home's market value to ensure it is worth the amount of money they lend you. The appraiser will typically review recent sales prices of comparable homes in the neighborhood, similar to the comp method your real estate agent used when determining how much you should offer for the home.

If the appraisal is lower than what you intend to pay for the home, you may have to pay the difference, as lenders typically only pay what they believe the home is worth. For example, if the appraisal estimates that the home is worth $190,000, but you put in an offer to purchase the home for $210,000, you will most likely be responsible for paying the $20,000 difference. You can also challenge the appraisal by filing an appeal or ordering a second appraisal.

3. Clear the Title and Close on the Property

"Clearing the title" of the property means that you become the rightful owner. The lender will need proof of title and will ask for a title search, which means you will be responsible for paying a title company to search public records for any documentation that claims the property isn't yours.

The title search will also look for any existing liens, which are charges against the property that were never paid. For example, if a plumber completed work on the property several years ago but was never paid by the owner, a lien might be placed against the property. You might be responsible for paying the lien when you purchase the property.

After the title has been cleared, you will meet with the seller, lender representative, and any other individuals involved to sign the paperwork, transfer funds, and receive the keys to your new home.

4. What should I expect to pay when buying a home in North Carolina?

It is important to ensure that you can afford the monthly mortgage payment and other costs involved in the homeownership process. Ensure that you have more than enough funds saved to cover the following expenses:

Due Diligence

The due diligence period is when the buyer pays the seller a non-refundable amount for a home inspection, termite report, and appraisal.

Repairs needed on the property will be negotiated between the buyer and seller on a case-by-case basis. During the due diligence period, the buyer will verify that the home appraises for the purchase price (or will decide if they still want to purchase the home if it appraises below the purchase price number). Loan approval also takes place during the due diligence period.

Earnest Money

Earnest money is how a buyer shows a seller that he/she is serious about purchasing a home. When the buyer signs the contract to buy the home, they will typically put down a deposit (called earnest money) totaling anywhere from $500 to $5,000. If the deal doesn't go through for whatever reason, depending on how the contract is worded, the buyer will typically get their earnest money back.

Earnest money is typically held in escrow by an independent third party, usually by a title company. It is important to note that if the buyer defaults on the contract, they can lose the earnest money. Defaulting on a contract typically happens when the buyer does not have the house inspected, surveyed, and appraised in the timeframe stated in the contract.

It is imperative to have these items completed shortly after signing the contract to ensure that the earnest money is not forfeited. If the buyer decides to back out of the contract altogether and does not move forward with purchasing the home, they will lose the earnest money. If the buyer does move forward with buying the house, the funds given for due diligence and the earnest money will be credited towards the buyer's closing costs and down payment at closing.

Down Payment

The down payment amount is contingent on the loan type that the buyer secures. For example, USDA, VA, and FHA loans are appealing choices for first-time home buyers because they typically require very little or no money down.

The standard down payment is typically 20%, but various options are available to first-time home buyers, such as only putting 5% or 10% down. Remember that the less money the buyer puts down, the higher the monthly mortgage payment will be.

Closing Costs

Closing costs are miscellaneous fees involved in the purchasing process, such as:

-

A fee paid to the lender for processing a loan

-

Payment to the title company for handling paperwork

-

A fee paid to the land surveyor and local government for recording the deed

Closing costs typically total approximately 3% to 6% of the purchase price. There is no way of knowing exactly what the closing cost total will be as the costs accumulate throughout the purchasing process.

5. Is Payment Assistance Available to First-Time Home Buyers in North Carolina?

North Carolina offers three first-time home buyer grants to assist in alleviating the purchase process:

The NCHFA Down Payment Grant Program

For first-time home buyers obtaining an FHA loan or conventional loan, a grant option, titled The NCHFA Down Payment Grant Program, offers a 3% down payment grant, meaning that the borrower only needs to have .5% for the down payment.

The NCHFA Down Payment Grant Program also offers a 3% down payment grant for conventional loans, meaning that the borrower only needs to cover their closing costs (which the seller is usually willing to assist in paying). These grant options also allow the down payment to be a family gift, which is often not allowed with other loan programs. Another program option offers 5% back in down payment grants on Government Loans.

NC 1st Home Advantage Down Payment

First-time buyers, those who have not owned a home as their principal residence in the past three years, and military veterans may be eligible for the NC 1st Home Advantage Down Payment, which offers $8,000 that can be used towards the down payment. This is a limited offering, but it is available in every county in North Carolina.

If the buyer is purchasing a home that is $260,000 or below, $8,000 can be given to provide assistance with the buyer's down payment and closing costs. The guidelines differ from those explained in the 3% or 5% options listed above, but they can be applied to closing costs on a USDA Home Loan or a VA Loan. This program cannot be used in conjunction with the First Time Home Buyer Tax Credit (MCC).

NC Home Advantage Tax Credit

This option can save home buyers up to $2,000 per year on their federal tax liability. The buyer must obtain a Mortgage Credit Certificate.

6. How Do I Apply For a Grant?

The first step in applying for a grant is to contact a qualified lender and complete a mortgage loan application. Your maximum income cannot exceed $87,500. After the lender obtains the necessary information from the loan application, they will ask the borrower for the following:

-

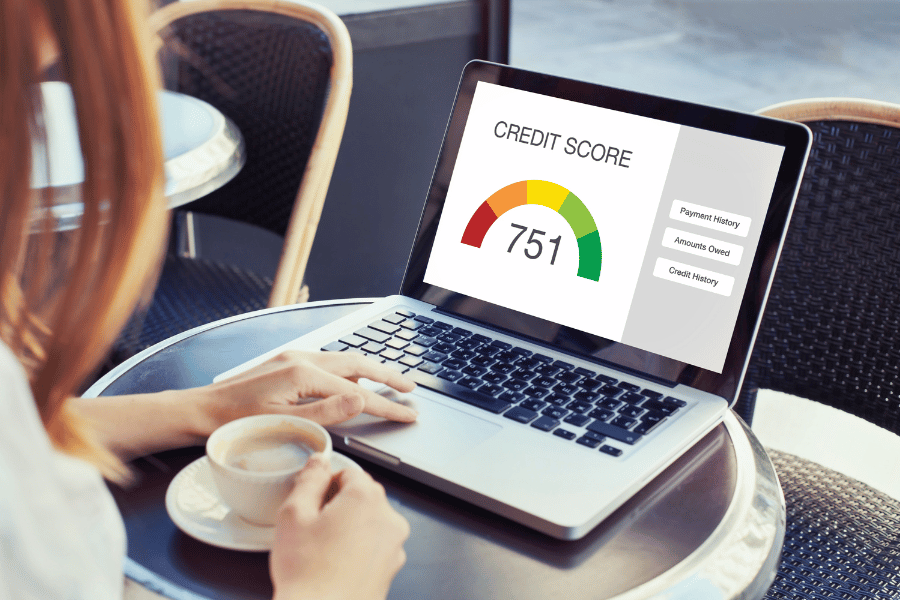

Minimum credit score of 640. This is typically contingent on your average credit score. If you have three scores and two scores are above 640, you have a greater chance of being approved.

-

If you have been renting or living with family for over three years, you can qualify for a First Time Home Buyer Grant.

After the lender determines that the applicant meets the abovementioned qualifications, they will determine which mortgage program works best and which grant they qualify for.

7. How Can I Prepare in Advance When Obtaining a Mortgage?

Calculate your income

If you own your own company, the mortgage application process might be a bit more involved. Additionally, if you have a considerable amount of student loans, credit card debt, or auto loans, the mortgage amount you will qualify for will be limited.

Paying these loans down as much as possible before applying for a mortgage is advisable. Avoid applying for credit cards or taking any new loan payments if this isn't possible. At the very least, bringing any credit card debts down to the lowest amount possible (or paying them off altogether) is advisable.

Review your credit score and credit history

It is typically advisable to have a FICO credit score of at least 680, but preferably above 700. If your credit score is less than that, you will most likely pay a higher monthly mortgage rate and might have to have a cosigner, such as a parent or relative, sign the paperwork with you. If your credit is under 680, an FHA loan might be the best option.

However, although these loans have lower down payments and allow lower credit scores, additional costs are typically involved. It is also important to not apply for anything involving a credit check when preparing to submit a mortgage application. Even something as seemingly minimal as applying for a new cell phone plan can be a red flag to a mortgage lender and may require an explanation.

Determine a healthy budget

Calculate the total housing payment, including the monthly mortgage, taxes, insurance, and any additional fees (such as Homeowner's Association fees, condo fees, etc., if applicable). The total payment should not exceed 30% of your pre-tax income. If you earn $90,000 a year in pre-tax income, your monthly housing payment should not exceed $1,875.

Save for the down payment

Although this varies, the mortgage lender will most likely require that the buyer put down at least 10 percent (unless you are applying for an FHA loan or something similar). If you can afford a 20 percent down payment, you will avoid paying private mortgage insurance, which protects the lender should you happen to foreclose on the property.

How to Obtain a Mortgage in Raleigh, NC - Final Thoughts

When you begin your real estate search, it will be tempting to go over budget. Having a bigger backyard or that extra bedroom may seem appealing, but remaining within (or under) budget is important. Although you may rationalize that the property will appreciate in value over time, remain conservative in your search to ensure you never miss a mortgage payment.

Don't give up if you have a relatively low or bad credit score or no credit history and are turned down. Different mortgage lenders have different requirements. One client asked 12 different mortgage companies for a loan before finally being granted a home loan.

Additionally, there is nothing wrong with taking extra time to shop around for the right lender. Meeting with two or three lenders and comparing their rates is generally advisable before committing to one. Speak with family and friends and ask for recommendations on who they used in the past. Read reviews online and try to learn as much as you can about them before scheduling a meeting.