Essential North Carolina Real Estate Laws Every Homeowner Should Know

Are you a North Carolina homeowner? Here is what you need to know about NC real estate laws.

Whether you are preparing to purchase your first home in Raleigh or you have been a North Carolina homeowner for years, understanding the state's real estate laws can protect your investment and help you avoid costly disputes.

The North Carolina Real Estate Commission governs ownership, transfers, and disputes. There are a couple of different laws that you should know about real estate in North Carolina that differ from other states.

Real Estate laws in North Carolina range from many regulations governing property transactions, leases, and relationships. When you are buying real estate, it is important to consult with a trustworthy real estate agent for help or refer to the North Carolina General Statutes for more specific details.

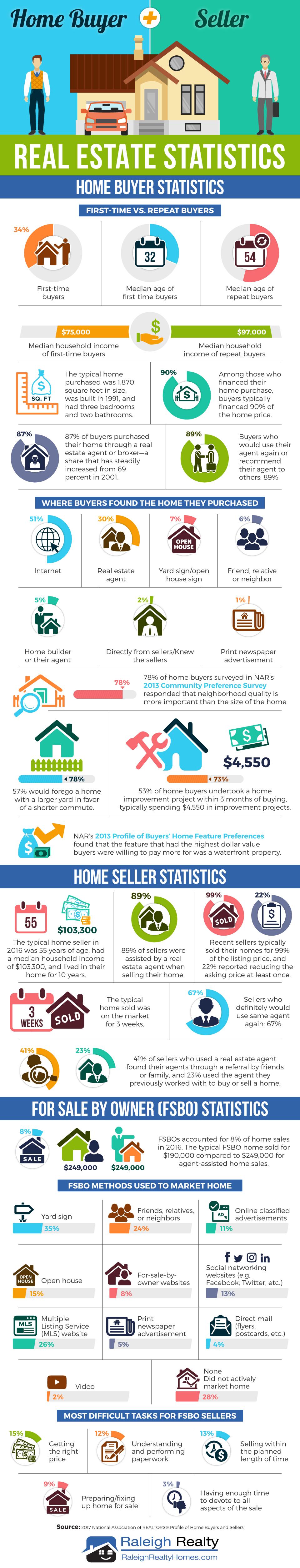

At Raleigh Realty, we believe informed homeowners make confident decisions. Here are five crucial North Carolina real estate laws that every property owner should understand.

Check out these North Carolina real estate laws.

1. North Carolina Homestead Laws

North Carolina's homestead laws provide certain exemptions and protections for homeowners. A homestead, which includes dwellings and associated buildings up to a value set by the General Assembly, or a lot in a city or town with a dwelling and building of the same value, is complete from sale under execution or final process for debts.

Under N.C. Gen. Stat. § 1C-1601, homeowners can exempt up to $35,000 of equity in their primary residence from creditors' claims during bankruptcy proceedings. For married couples filing jointly, this amount doubles to $70,000.

If you face unexpected medical bills, business debts, or other financial challenges, creditors generally cannot force the sale of your home to satisfy those debts if your equity falls within the exemption limits. However, this protection doesn't apply to mortgage lenders, tax liens, or mechanics' liens for work performed on your property.

Keep in mind that homeowners in North Carolina may be eligible for a tax break on their homestead through the Homestead Exclusion program. This program allows qualifying individuals to exclude a portion of the assessed value of their primary residence from property taxes. To be eligible, the homeowner must meet certain criteria, such as being at least 65 years old or totally and permanently disabled.

The homestead exemption only applies to your primary residence, where you actually live. This does not include investment properties or vacation homes. You must also file a homestead exemption claim to activate this protection.

For more information, visit the North Carolina Department of Revenue website for detailed information about the program and requirements for homeowners under this law.

.png)

2. North Carolina Property Lines and Fence Laws

In North Carolina, property line disputes are typically resolved through civil actions and legal proceedings. Property owners are encouraged to establish clear boundaries through surveys or boundary agreements to prevent conflicts with other real estate properties.

The state doesn't require property owners to build or maintain fences, but if you choose to install one, understanding the law can prevent neighbor disputes.

When it comes to fencing and local zoning ordinances, homeowner's association rules often state the specific requirements for height, material, and placement of fences.

Before installing a fence, review your deed, obtain a survey, check HOA rules, and communicate with neighbors to maintain good relationships and legal compliance.

Key points about NC fence laws:

Boundary surveys: When purchasing property, always obtain a current survey. North Carolina courts strictly enforce property boundaries as established by licensed surveyors, and even long-standing fences may not represent the true legal boundary.

Spite fences: You cannot build a fence solely to annoy your neighbor or block their view. Courts can order the removal of fences built with malicious intent.

Shared fence costs: If you and your neighbor agree to build a boundary fence together, North Carolina law recognizes this as a shared expense. Written agreements are crucial to avoid future disputes.

Adverse possession: If someone openly uses part of your property for 20 years continuously without your permission, they may claim legal ownership through adverse possession. Regular property surveys and addressing encroachments promptly protect your boundaries.

3. North Carolina Lease and Rental Agreement Laws

Whether you're a landlord renting out investment property or a homeowner considering renting your Raleigh home temporarily, North Carolina's landlord-tenant laws establish clear guidelines under the North Carolina Residential Rental Agreements Act (N.C. Gen. Stat. § 42).

Here are critical requirements for landlords in North Carolina:

Written Lease

Written leases are not always required, but it is advisable to have a written lease agreement in place to establish the terms and conditions of the property. Having a written lease helps protect the landlord's and tenant's rights and obligations.

Security Deposits

Landlords can charge up to 1.5 months' rent for a week-to-week tenancy, one and one-half months' rent for a month-to-month tenancy, and up to two months' rent for terms longer than month-to-month.

Deposits must be returned within 30 days after the tenant moves out, minus any itemized deductions for damages beyond normal wear and tear.

Rental Payments

Landlords must provide tenants with a receipt for any payment made in cash unless the tenant pays through a personal check or money order. The landlord is required to provide written notice of any changes to the rental amount or payment terms.

Entry Notice

The landlord must respect the privacy of tenants and may enter the rental unit only under specific circumstances, like emergencies or with prior notice for repairs and inspections.

Habitability Standards

Landlords must maintain properties in safe, habitable condition. This includes functional plumbing, heating, electricity, and structural integrity. Tenants can withhold rent or terminate leases if landlords fail to make necessary repairs after proper notice.

Lease Termination and Eviction

North Carolina requires strict adherence to legal eviction procedures. Landlords cannot use "self-help" methods like changing locks or removing tenants' belongings without a court order.

4. Real Estate Fraud Protection

North Carolina takes real estate fraud seriously, with multiple statutes protecting homebuyers and sellers from deceptive practices. Understanding these protections helps you recognize warning signs and take appropriate action if you suspect fraud.

Real estate fraud laws are primarily covered under Chapter 14, Article 23 of the North Carolina General Statutes. This article specifically addresses offenses related to real estate, including fraud, pretenses, and obtaining property by pretense.

Below are some of the key things to know about fraud in North Carolina when relating to real estate property.

Mortgage Fraud

Mortgage fraud includes providing false information on loan applications, property flipping schemes with inflated appraisals, or foreclosure rescue scams. Under federal and state law, mortgage fraud is a serious felony offense.

Deed Fraud

Criminals forge property deeds to steal ownership. North Carolina law requires all deed transfers to be properly notarized and recorded with the county Register of Deeds. Always verify the legitimacy of any deed documents and monitor your property records periodically.

Wire Fraud

Scammers intercept real estate transactions by sending fake wiring instructions that divert closing funds. Always verify wiring instructions by calling your title company or attorney using a number you independently confirm. Never trust email instructions alone.

Real Estate Disclosure Requirements

North Carolina has specific laws regarding real estate disclosures. Sellers of residential properties are required to provide certain disclosures such as including known material defects or hazards that may affect the value or desirability of the property.

Enforcement and Penalties

Real Estate fraud offenses in North Carolina can lead to criminal charges, civil lawsuits, or both. The penalties can vary depending on the severity of the offense, and individuals found guilty of real estate fraud may face imprisonment, fines, restitution, or other legal consequences.

The North Carolina Real Estate License Law also holds licensed agents to high ethical standards. If a real estate agent engages in fraud or misrepresentation, they face license suspension or revocation, plus potential civil and criminal liability.

Make sure to watch out for certain red flags, including pressure to act quickly without proper inspections, requests to leave documents blank "to be filled in later," unusual payment instructions, and prices significantly above or below market value.

.png)

5. Who Regulates Real Estate Laws in North Carolina

Real Estate laws in North Carolina are regulated and enforced by multiple entities at the state level. Understanding which government bodies oversee real estate activities in North Carolina helps you know where to turn with questions, complaints, or regulatory issues.

If you experience issues with a real estate transaction, knowing the right agency to contact is essential. License issues go to NCREC, criminal fraud to law enforcement, deed problems to the Register of Deeds, and attorney misconduct to the State Bar.

Here are some of the key bodies that are involved with overseeing real estate laws in North Carolina.

North Carolina Real Estate Commission

The NCREC is responsible for regulating and licensing real estate professionals, including real estate agents, brokers, and property managers. The commission ensures compliance with the North Carolina Real Estate License Laws and sets standards for ethical conduct and professional competence in this industry.

What NCREC oversees:

- Licensing requirements for real estate brokers and firms

- Continuing education for license renewal

- Investigation of complaints against licensed brokers

- Enforcement actions, including fines, suspensions, and license revocations

- Trust account management and escrow practices

When you work with a licensed real estate broker in North Carolina, you have recourse if they violate professional standards. You can file complaints with NCREC, and the commission has the authority to investigate and take action.

Local Governments

Local governments in all cities and countries have their own planning and zoning departments that enforce the local regulations and codes for buildings and land. These departments are there to oversee matters such as zoning restrictions, building permits, and compliance with local ordinances regarding real estate.

North Carolina Department of Justice

The North Carolina Department of Justice plays a big role in enforcing and prosecuting real estate fraud and other related offenses. It investigates complaints, initiates legal actions, and works to protect consumers from fraudulent actions throughout the real estate industry.

North Carolina Department of Insurance

The NCDOI oversees various aspects of insurance-related matters in North Carolina, including the regulation of title insurance. Title insurance is a crucial aspect in real estate transactions, so the NCDOI is there to set the laws and regulations for this area.

Methodology

Data was sourced from the North Carolina Department of Revenue, the North Carolina Department of Justice, and the North Carolina Real Estate Commission to determine North Carolina real estate laws that every homeowner should know.

FAQs

Does a spouse automatically inherit everything in North Carolina?

If you have no living parents or descendants, your spouse will inherit all your interstate property, but if you have parents alive, your spouse will have half of the real estate and the first $100,000 of personal property.

Is North Carolina a common law property state?

Most states, including North Carolina, follow the common law property system, which means each spouse solely owns and controls any property he or she acquires during the marriage and titles it in their name. When one dies, they will determine what happens with the property.

What is required for a real estate license in North Carolina?

The laws for getting a real estate license in North Carolina require completing the state-approved 75-hour broker prelicensing course while passing the North Carolina State Licensing exam with a score of at least 75%.

What are the state limitations for real estate in North Carolina?

In North Carolina, whether your potential case involves damage to real property or personal property, it usually must be brought to the state's civil court system within 3 years. This can be found in the North Carolina General Statutes section 1-52.

Real Estate Laws in North Carolina That You Should Know - Final Thoughts

North Carolina's real estate laws exist to protect homeowners, buyers, and renters throughout their property journey. While this overview covers five essential legal areas, real estate law is complex and constantly evolving.

Multiple regulations govern property transactions, leases, and relationships in North Carolina. If you recently inherited a property, make sure you understand the laws.

Whether you are buying your first home in Raleigh, managing rental property, or protecting your current residence, understanding your rights and responsibilities under North Carolina law empowers you to make confident, informed decisions.

If you are moving to Raleigh and have questions about real estate laws, contact the experts at Raleigh Realty. Our experienced team is here to help you through your real estate journey.