Short-Term Rental Laws and Regulations in Raleigh

Considering investing in short-term rental properties but need to know more about the laws? Here are the short-term rental laws and regulations in Raleigh, NC.

Investing in real estate has many benefits. However, before you start, you need to understand the laws in your area. Short-term rental laws and regulations will vary depending on the property location; in Raleigh, the city strictly enforces all regulations to ensure the safety and compliance of short-term rental properties.

Before you open your short-term rental property, complete the application and checklist. This includes zoning permits, property owner information, required documents, and acknowledgment of rental standards.

While it may seem like a great deal of work, short-term rentals are known to make you more money than long-term rentals. Investing is a great way to build your own equity and increase your cash flow. Remember the current market conditions, as it is important to evaluate the local housing market, home prices, and interest rates before investing.

The Raleigh economy is predicted to continue growing with the arrival of big companies such as Apple, Google, and Meta in the area. This might be the best time to start investing in Raleigh. First, you need to ensure compliance with all laws and regulations. Here are the seven more important short-term rental laws and regulations in Raleigh.

Keep reading to learn about Raleigh, NC's short-term rental laws and regulations.

1. In Residential Zoning Districts, Short-Term Renters Shall Not Utilize The Premises for Holding Special Events or Gatherings

Depending on where the property is located, there are restrictions on holding events or large gatherings on the short-term rental property. This is due to concerns about excessive noise, disruption to neighbors, property damage, and violation of local zoning ordinances.

Large gatherings are more likely to damage property, including furniture, appliances, and the building itself. Additionally, noise disturbances are significant in residential areas.

If a tenant holds a special event or large gathering, there may be legal implications, with potential penalties for violations. To manage gatherings at short-term rentals, hosts should clearly state on the listing that gatherings are not allowed and specify the maximum occupancy allowed.

Before investing in short-term real estate, understand and comply with all local laws. Many short-term rental owners use noise-monitoring technology to monitor their property. However, any cameras should be stated on the listing and should only be on the exterior property.

2. No Exterior Advertising Shall be Allowed

In the context of short-term rentals, no exterior advertising means that signs, banners, or other visible advertisements on the building are not permitted. These are typically used to promote the rental property and attract guests.

This regulation includes yard signs, window decals, or banners related to the property. This is for specific reasons like maintaining neighborhood aesthetics. Many homeowners associations (HOAs) have strict regulations to maintain the visual appearance of a neighborhood which must be followed.

Advertising is still allowed online, although exterior signage is not permitted. This is partially why property owners can still advertise their rentals on Airbnb, VRBO, or through social media sites with virtual tours.

3. Rental Operators Shall Comply With All Applicable State and Local Laws

This may be an apparent law to comply with all applicable state and local laws. However, it can be more difficult if rental owners own properties in other states or cities. State and local laws vary, so it is vital to understand the laws in your property area, especially when renting out your home's extra space.

Landlords are required by law to keep the property safe and habitable. As a tenant, being aware of your rights in that state is a good idea. For example, if there are natural disasters such as hurricanes, your landlord may offer you insurance on your vacation rental. This covers the cost of any nights missed due to a mandatory evacuation.

Local and state laws include fire and building codes, smoke-detecting and carbon monoxide-detecting equipment, housing codes, and payment of taxes to appropriate governmental entities, including occupant taxes.

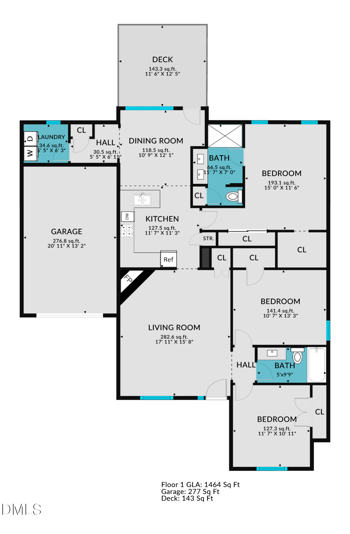

The zoning permit must be renewed annually, and the permit has to be displayed in any rental advertisements. Hosts should obtain the zoning permit, business license, proof of insurance, property inspection report, signed affidavit, property deed, and floor plans in order to operate a short-term rental legally. These documents may vary depending on the location, so ensure you have everything complied with before operating the rental.

Failure to provide these documents could result in fines, penalties, and the potential shutdown of the short-term rental business. The zoning permit and business license may take up to 4 weeks to obtain as long as all the requirements are met.

4. Cooking Facilities Are Not Permitted In Any Bedroom

Cooking facilities are not permitted in any bedroom. According to this regulation, cooking facilities may include any refrigerator in excess of seven cubic feet, any stovetop two range that operates on 220-volt electric service, any appliance that operates on natural gas, or any cooktop, whether integrated into a countertop or a separate appliance, which contains more than two cooking surfaces or burners.

According to the City of Raleigh, this shall not prohibit cooking facilities within a one-room studio short-term rental. For this purpose of this regulation, a studio shall be a single-room rental with a sleeping area, living area, and a kitchen/eating area in one consolidated room.

All hosts must comply with fire and building codes. This includes applicable fire, building, and housing codes, just as any homeowner would. It is essential to ensure that any renters also adhere to these codes during the term of their lease.

5. Lodger List

Hosts must keep a complete list of all lodgers for three years. In North Carolina, this list is used for transparency and accountability. Previously, short-term rentals were considered illegal businesses. This was until new laws were introduced on March 4, 2021. It is important to keep records of all tenants who stay on the property.

A lodger list is also necessary in order for hosts to comply with local and state taxes like occupancy taxes.

6. Occupancy and Parking Regulations

Short-term rentals can only accommodate up to 30 days of occupancy. If the rental is occupied for more than 30 days, then it is a long-term rental. A long-term rental has different laws and regulations that must be adhered to.

In addition, the number of occupants is limited to two people per bedroom plus two extra adults. For this reason, many short-term rental hosts are strict about occupants. Many short-term rentals only have room for a specific number of cars as well. This is because the number of cars cannot exceed the number of bedrooms.

This is why landlords are strict about the number of people allowed on their property, and all tenants should be transparent about the number of people staying. The landlord could get in legal trouble or be fined if any of these regulations are not followed.

7. Taxes and Insurance

Short-term rental hoses in Raleigh are responsible for several taxes, many similar to taxes all homeowners must pay. The following are the short-term rental taxes:

- State Sales Tax: 4.75% as of 2024

- Local Sales Tax: Varies throughout Wake County, although it is typically between 2% and 6%.

- Room occupancy tax: Also known as the Vacation Rental Tax, this varies depending on the location and type of rental property.

Hosts may use an automated system to collect taxes. However, all hosts must keep records of rental income, tax obligations, and exposure for at least three years, just as you should keep a record of all essential documents related to your property.

Platforms like Airbnb and VRBO can collect and remit taxes on the host's behalf. However, if guests book the property directly through the host, then the host is solely responsible for paying state taxes.

These platforms may also offer "free" short-term rental insurance for every booking on the platform. There is an Airbnb Host Guarantee, which provides $1,000,000 of "free" property coverage, and the Airbnb Host Protection, which provides $1,000,000 of "free" liability coverage.

Methodology

We used information and data from several different sources, as well as our own data, to determine everything you need to know about the short-term rental laws and regulations in Raleigh, NC. Most of the data was sourced from the following sources:

- North Carolina Department of Justice (NCDOJ)

- Airbnb

- The City of Raleigh

FAQ: Short-Term Rental Laws and Regulations in Raleigh, NC

Here are some commonly asked questions about the short-term rental laws and regulations in Raleigh, NC.

Do you need a permit for Airbnb in NC?

Airbnb hosts must obtain a zoning permit and display it on the listing as well as in the units in North Carolina. Rentals are only allowed in residential dwelling units and must be separated by at least 750 feet.

What is the North Carolina Vacation Rental Act?

North Carolina's Vacation Rental Act protects consumers who rent a vacation property for fewer than 90 days. According to the NCDOJ, the landlord or real estate broker must provide you with a written rental agreement that clearly states your rights and obligations as a tenant.

How many days a year can I rent out my Airbnb?

According to Airbnb, registered hosts are only able to host for up to 120 days per calendar year. However, you can apply for an extended home-sharing permit (EHS), which allows for short-term rentals 365 days per year.

What is considered a short-term rental in North Carolina?

A short-term rental in North Carolina is a residential property for vacation, leisure, or recreation purposes for fewer than 90 days by a person who has a separate place to which they intend to return.

What is a short-term lease agreement in NC?

In North Carolina, a tenant can sign a month-to-month rental agreement that renews monthly until the landlord or tenant provides a notice to terminate. Remember, the minimum requirement is seven days to cancel the agreement.

Short-Term Rental Laws and Regulations in Raleigh, NC - The Bottom Line

Similar to owning any property, homeowners must comply with all laws and regulations in that area. Owners should be aware of all local regulations, as they can vary from place to place.

Raleigh has organized zoning districts to manage land use and development. Each district has specific regulations and purposes. These include single-family homes, duplexes, apartments, and townhomes. If you are considering a short-term rental property in a specific zone, ensure you obtain the zoning permit.

This article aims to educate both future landlords and tenants. If either party does not follow these laws or regulations, they may be fined or risk losing the property to the city.

Raleigh, NC, is a great option if you are considering investing in short-term rentals. Feel free to contact one of our helpful real estate specialists, as they are eager to help you find the perfect location. We know that investing can be overwhelming, but a real estate agent can walk you through the entire process.