What Happens Next Once an Offer is Accepted?

What do you do after you go under contract on a home? Here are ten things you should do once an offer is accepted!

Congratulations! Your offer has been accepted, and you're now under contract on your new home. While this is cause for celebration, the journey to homeownership isn't over yet. In fact, in many ways, it's just beginning.

"Once a seller accepts my offer, what happens next?" This is a common question from buyers after they go under contract on a home in Raleigh.

After a buyer's offer is accepted, you'll want to visit the home numerous times before closing day. This includes meeting with your Real Estate Agent, Inspectors, Contractors, and Appraisers. You'll also want to schedule a final walk-through, which your Realtor will set up.

The period between contract and closing is filled with important tasks, deadlines, and decisions that can significantly impact your home purchase experience. Let's walk through the 10 essential steps you'll take after going under contract on a home.

Take these next steps after going under contract on a home

1. Call your Real Estate Team

The seller just accepted your offer, and you're officially under contract. So what's the next thing you do? There's probably an urge to post something on Facebook or another social media platform. Do not do that just yet because many things can go wrong in a real estate transaction.

If you start posting on social media, you put added pressure on yourself to close the deal. Our recommendation at Raleigh Realty is to tell your immediate family and some close friends just to be careful about sharing it with the world. Once a home is under contract, it will be marked online as contingent or pending.

You need to connect with your real estate team and let them know you're now under contract. This will get the wheels turning. Your real estate agent will be able to walk you through the process of who you need to contact.

Set the dates and times with your team (including closing and inspection dates). There are many people on your home-buying team that you should be prepared to hire.

Depending on what part of the country you're buying a home in, your real estate team is likely to include different players. Here in Raleigh, when you buy a home, your team is likely to include the following:

- Realtor

- Lender

- Inspectors (you will likely have more than one)

- Attorney

- Insurance Agent

- Contractors

There is a lot more to your real estate team that happens behind the scenes, these are people you're likely never to see and probably won't ever hear from.

Once the Lender, Inspector, Attorney, and Insurance Agent know you're under contract, they can assemble everything you need. You may want to connect with contractors if you want estimates. This will give you an idea of the cost to do things like add hardwood floors or another bathroom.

2. Submit Your Due Diligence Fee and Earnest Money

If there is due diligence and earnest money, that will need to be given to your Realtor as soon as possible. You may not have this in your contract if you do, it needs to be delivered immediately. Failure to deliver the funds promptly may result in a breach of contract.

Due diligence money is paid directly to the seller and secures your right to walk away from the transaction for any reason during the due diligence period. It also allows you the opportunity to inspect the property once your offer is accepted. Your real estate team will include inspectors of all sorts, the captain of this team is your home inspector. You'll have an opportunity to inspect for pests and hazardous items as well inside the house (jump to inspections).

Your due diligence money is good for a certain timeframe that you agreed to with the seller, and you will have the opportunity to ask for an extension should you require one. Make sure your lender can get the home appraised in this time period.

The likelihood of closing is much greater once the due diligence period is over and you've made your request for repairs.

3. Send your Lender Documents ASAP

Your lender is going to need to clear you to close. To do this, a lot needs to happen. There is a list of things they will need from you, and you need to make every effort to send those documents to them as soon as possible. Once your offer is accepted, you still need to take care of a lot of work, and it's mostly with the financing portion.

Your lender will require items like W2s and other identifiable tax-related information as they will need to verify your income. The list of items needs to be delivered to your lender as soon as possible, or you will be unable to close on time. It's a wise idea to connect both your Realtor and Lender early on so they can work together and help you.

4. Set a Closing Date with your Attorney

In Raleigh, there is a specific closing date in the contract. This is not the case for other places in the country. For instance, New York has an 'on or about' closing date that drives both buyers and sellers crazy with uncertainty.

As a buyer, you always have the opportunity to amend the contract, and the seller can accept or decline proposed changes.

You'll want to make sure you schedule the closing early enough so that the attorney you want to work with has time on that day. Connecting your Real Estate Agent to your Lender and Attorney is a great idea to work together.

Your attorney will need their forms filled out to prepare your closing.

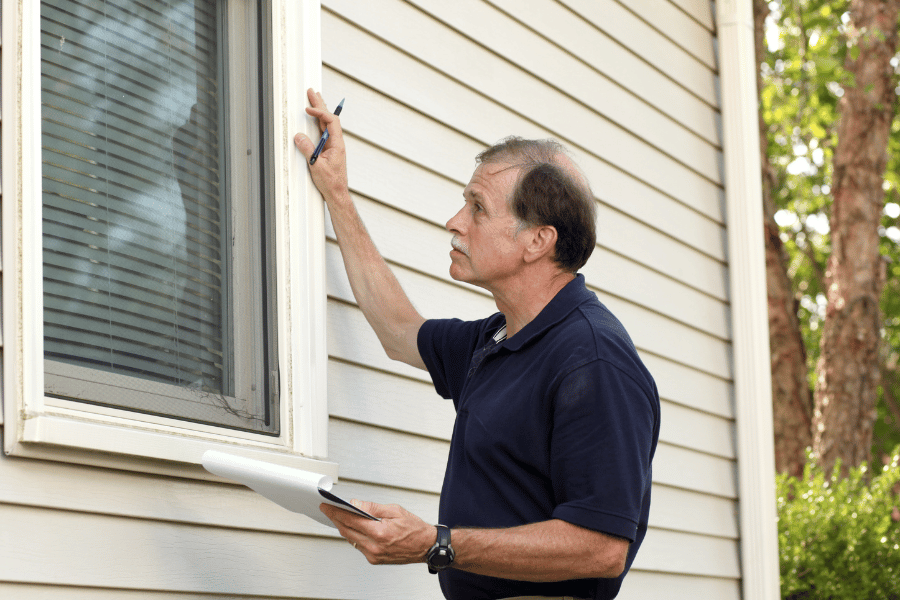

5. Time for a House Inspection

Given North Carolina's due diligence period (typically 14-30 days), you'll want to schedule your home inspection immediately to leave time for additional specialized inspections if needed.

It is reccommended to schedule a home inspection within 3-7 days of going under contract. You will want to inspect the property for any and all things that could be wrong with it. Some of the main items you'll want to be on the lookout for include foundation, roof, HVAC, plumbing, and electrical issues.

Certain issues arise on a home inspection often, and there are others you'll want to ensure don't appear. Make sure you set your expectation that the home inspector you hire will be able to find problems with the house.

Neighborhoods with historic properties tend to have more issues with foundation and electrical systems while homes in new construction neighborhoods have more drainage issues resulting from rapid development.

Before your due diligence period ends, you will want to strongly consider other specialized inspections including radon testing, termite inspections, and HVAC system evaulations.

The average cost of a home inspection is $343, but the total cost will depend on the location, size,and age of the home.

6. Your Home Appraisal

Ensure your lender will have your home appraised during the due diligence period otherwise, you may find out it doesn't appraise and lose your earnest money. Once a seller accepts your offer, they want the deal to go through just as much as you do, so they're pretty open to extensions should you need to request extra time for your appraisal.

Having your home appraised is part of what ensures the money the bank is giving you is enough so that they can recoup most of it should you stop paying your mortgage.

A home appraisal is the bank's way of figuring out if the amount of money they are lending to you is more or less than the value of your home and that you are not overpaying for something.

Many real estate agents will tell you that you can't overpay for a home because the bank appraises it. There is some truth to this, though it's safe to say it isn't 100% accurate.

You have options when the home doesn't appraise and a chance to negotiate a better price. We have seen homes appraise for much less than they should and appraise for more than their market value.

For a single family home, the average cost of a home appraisal is $357, but the final cost will depend on the size of the property and its condition.

7. Due Diligence Repairs Request

Once you have the reports back from all of the inspectors, you have the opportunity to negotiate repairs with the seller. Some sellers are more than willing to make repairs, while others will deny your request.

Of all the deals that go under contract, this is where a lot of them can be lost. Buyers and sellers need to understand each other's position and whether or not it makes sense to continue with the sale based on the repair requests.

Consider asking for a closing cost credit rather than repairs when possible. This gives you control over the work quality and contractor selection after closing rather than relying on the seller to complete repairs to your standards.

8. Home Insurance

Home insurance is an important step in buying a home. You'll want to be sure to find an insurance agent you like and that your insurance plan covers everything you want.

Most home insurance plans are typically based on several different factors, so you’ll want to be sure you check in with a few different home insurance agents.

Many buyers choose the first one only to realize later they spent a couple of hundred dollars more than they needed to. It is essential to always compare quotes.

9. Turn Utilities on in the Home

One of the last things you'll do a handful of days before moving in is set up your utilities. You can contact the listing agent to see who the seller's current providers are so that you can either remain with them or switch to someone you like.

You'll want to turn on things like electricity, gas, water, cable, and internet. That way, you're ready to go when you move into your new home.

The final step is moving in, you may want to hire a moving company to help you move all of your stuff. Many problems can occur with moving companies, so be sure to avoid all of them that you can.

10. Close and Move into Your New Home

Closing day in North Carolina involves signing legal documents, paying closing costs, and receiving keys to your new home.

It took an army to make it happen; you should be proud. You're probably exhausted after the home-buying process. It can definitely take a lot of work, but it's all worth it.

One of the final items you'll need to take care of is an address change. You'll want to ensure all your mail is now at your new address.

It's also a great opportunity to meet your new neighbors. When you see them outside, don't be afraid to wave, and follow that up by walking over and introducing yourself.

Most people form great relationships with their neighbors right off the bat. It's an awesome opportunity to meet others in the neighborhood as well through your direct neighbors.

If you plan a housewarming party, you may want to give yourself a few weeks to settle in first. It can take that long to really 'move in' to a new place. There will always be little things to do the first few weeks after moving in, whether mounting the TV to the wall or placing pictures around the house.

Methodology

To determine the next steps to take after going under contract on a home, data was sourced from Bankrate and Angi in May 2025.

FAQs

Does under contract mean sold?

The term "under contract" means that the seller has accepted an offer, but there are still steps to take before closing. The terms "under contract" and "pending" are sometimes used interchangeably.

Can I change my mind after my house is under contract?

It is possible to back out once your house is under contract, but it may be difficult to pull out without losing money if you are not careful.

Steps After You Go Under Contract - Final Thoughts

The path from contract to closing contains numerous steps, each with their own timeline and requirements. Working with experienced professionals can make this journey smoother and less stressful.

From helping you understand due diligence periods to recommending trustworthy local service providers, our goal is to make your homebuying experience as seamless as possible.

If you are moving to Raleigh and ready to find your dream home, contact the experts at Raleigh Realty. We pride ourselves on guiding our clients through each phase of the homebuying process.