7 Vacation Home Buying Tips

Are you considering buying a vacation home? Here are seven vacation home-buying tips you should follow.

Buying a vacation home seems like the dream. However, there is much to think about. Buying any type of home is a big decision that requires a lot of planning and work. However, it'll all be worth it when you're sitting in your new and beautiful vacation home.

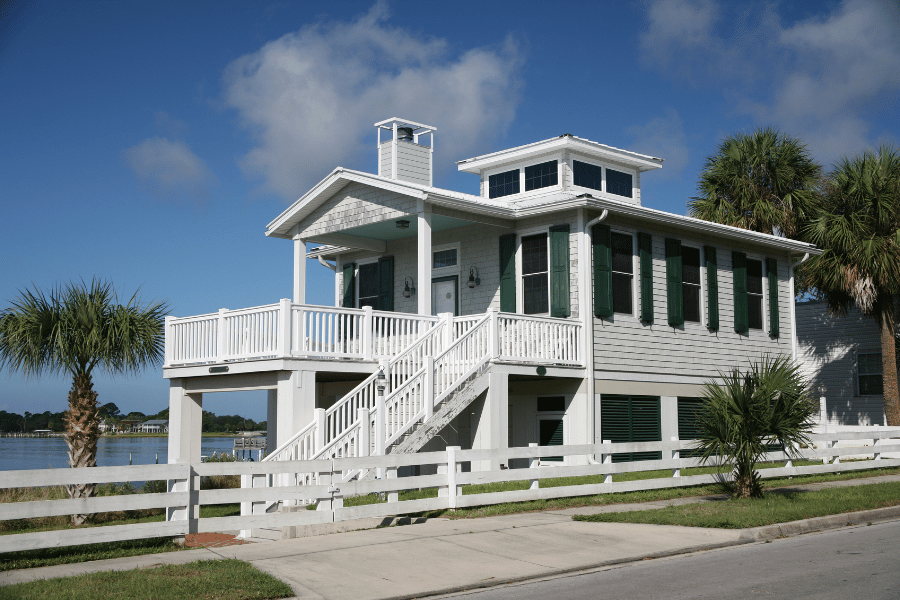

Whether you are looking for a home on the coast, lakeside, or in the mountains, you still need to follow these simple steps. Vacation homes are often considered to be second homes, typically in a different location than the owner's primary home.

Owning a vacation home means you have an extra place to relax and wind down. It also gives you another opportunity to make some extra cash. Many vacation homeowners who rent out their properties are also allowed tax benefits to help make the home more affordable. The tax breaks are contingent on meeting IRS requirements, including how many days it is rented or used by the owner.

Remember that buying a vacation home is different than buying a primary home. You may need a larger down payment and meet certain criteria to qualify for loans. No matter why you are interested in buying a vacation home, you should definitely follow these tips to make the process as smooth as possible.

Keep reading to learn about these seven vacation home buying tips.

1. Plan For Future Expenses

One of the most important parts of buying a vacation home is planning for future expenses. Not only will you need to pay the typical home expenses, but you should set aside extra cash for potential repairs and renovations.

You will need to pay the monthly mortgage payments and several other expenses; some may be one-time payments, and others may be monthly bills. These expenses include homeowners insurance, property management, home furnishings, a security system, and house cleaning.

If you are planning on renting out the property, you may need to save up some extra cash for cleaning services between guests. If the property is in a gated community, it is still a good idea to set up a security system to protect yourself and your renters.

Property management can include repairs and outdoor landscaping. You may need to find reliable companies in the area if your primary home is far from your vacation home that you can trust while you don't have the time to check on the home.

Ensure you know about all the extra expenses of a vacation home before buying one. They will add up on top of your primary home expenses, so you need to be prepared with enough savings and planning. Remember that double the home means double the expenses.

2. Consider Your Lifestyle

Another vital thing to consider when deciding if you are going to buy a vacation home is your lifestyle, which can vary by generation. How often do you plan on staying at your vacation home? Will you rent it out, and how often do you plan to rent it out? How will you take care of the property when it is vacant?

You should absolutely plan on how you will use the home and how to take care of it while you're away. A property manager is a great solution to this problem. They can take care of the routine maintenance and check on the home after renters or storms. There are many companies available that provide different plans based on the frequency of use, services, and square footage, according to the National Association of Realtors.

You should think about how often you'll be able to visit the vacation home in order to plan the number of bedrooms, baths, and more. For example, if you want a vacation home with a pool, you'll need to visit regularly in order to keep up with pool maintenance. Pools are not cheap, and although you may make more from renting a home out with a pool, an inground swimming pool can cost anywhere from $25,000 to $80,000, depending on the type of pool and size.

If you plan on visiting the home regularly with your immediate or extended family, consider buying it with other trusted family members. This will save money and allow the whole family to enjoy the property together.

3. What Are Your Financial Goals?

Along with planning your vacation home around your lifestyle, you should think about your financial goals. All vacation home buyers should establish their financial goals early in the process. This will help you determine many factors, including the location. If you want to use the home as a way of earning passive income through renters, then you may need to look at popular tourist locations.

On the other hand, if you want a home to visit for leisure, you can have more flexibility on the exact location. You need to determine if you are looking for a home to generate income. Include the costs for a full-service manager or taking on the responsibility of management on your own. You'll need to ask yourself many important questions before even deciding on buying a vacation home.

There are real estate agents who specialize in vacation homes, and you should definitely get in touch with them. These agents can offer rental income projections based on set data to ensure the property will help you reach your financial goals.

4. Determine The Location

According to Pacaso's 2022 Second Home Attitude Report, location is the most important factor in the purchasing decision for second homeowners and aspiring homeowners. Two-thirds of people (64%) commute or expect to commute to their second home in four houses or less, and the majority (87%) want to drive.

While you evaluate your lifestyle, determine how often you will be visiting the home and how you will travel. If you are buying a home you need to fly to, you'll need to factor travel costs into the expenses. The same goes for if you are one of the 87% who plan on driving to their vacation home.

Approximately 71% of buyers plan to visit their second home less than 7x per year. You can use this statistic to base the frequency of your visits if you aren't quite sure how often you'll visit.

The location has the largest effect on home values, thanks to the impact the location has on the desirability of a home. This is still true for vacation homes, especially if you plan on renting out the home while you aren't there.

Renters will be looking for homes in good locations for vacation. This may mean that your home will be more expensive upfront, but you could also pay it off faster with higher renting costs.

5. Work With an Agent Who Specializes in Buying Vacation Homes

When buying any type of home, you should work with a real estate agent who specializes in that type of home. A specialized agent will understand how they are different from primary residences. The National Association of Realtors provides training and accreditation for certified vacation home agents, called Resort and Second-Home Property Specialists.

Make sure you are working with an agent who is familiar with local regulations in the area you are interested in. You need to know how the home is zoned and how short-term rentals are regulated in that area.

A specialized agent will help you find the property that is most suitable for your lifestyle and financial situation. They will let you know about the local vacation rental performance and what features and amenities will help the listing stand out.

6. Qualify For A Second Home Mortgage

Just like buying your primary home, you need to determine if you can afford a vacation home. You need to ensure you are eligible for a second home mortgage, and this may have different requirements than those for a primary home.

You should check your credit score and make sure you have the funds for a down payment of 10% or more. Once you are qualified for the loan, apply for a mortgage preapproval and start the house-hunting process.

If you need to raise your credit score, there are several ways to quickly improve your credit score for a mortgage. This includes paying bills on time, paying off your debts, and routinely checking your credit reports and scores.

7. View The Home as a Form of Recreation, Not an Investment

The most important thing to think about while searching for a vacation home is considering what area you enjoy. It will be worth the extra cost if you will be spending a great deal of time there.

Many vacation homeowners don't rent the home out and plan on living in it almost as much as their primary home. In this case, you need to ensure you will love it as much as you love your primary one. No matter what, think about your home must-haves and nice-to-haves. This is a great way to determine what you are looking for in a home and what you can possibly live without.

Methodology

We used information and data from several different sources, as well as our own data, to determine everything you need to know about buying a vacation home. Most of the data was sourced from the following sources:

FAQ: Vacation Home Buying Tips

Here are some commonly asked questions about buying a vacation home.

What is the rule of thumb for buying a vacation home?

In order to cover the extra expenses when buying anything, you should always calculate how much you should have in savings. A good rule of thumb is to save an extra 1% of your home's purchase price for maintenance or renovations.

Is it hard to finance a vacation home?

It can be a bit harder to qualify for a vacation home loan than it is for a primary property. This includes a stricter debt-to-income ratio, credit score, and down payment requirements. Contact a lender to learn more about your local regulations.

Is it a good idea to invest in a vacation home?

Buying a vacation home can be a great investment as they appreciate value over time. Whether you are planning on renting out the home while you're at your primary home or living in it part-time, the value of your investment property can climb over time.

What is the difference between a vacation home and a second home?

A vacation home is a type of second home where the owners visit throughout the year for leisure but do not reside there permanently. In order to qualify as a second home, the owner must use the home at least 14 days of the year and cannot rent out more than 180 days of the year.

Can a vacation home pay for itself?

When managed effectively, a vacation rental can cover the expenses you used to buy the home and turn into profit. It may take some time, but it is a rewarding endeavor that can provide you with a home away from home and potential income.

Vacation Home Buying Tips - The Bottom Line

Similar to buying your primary home, you should still be flexible and patient. It may take time to find the perfect home, but as long as you are educated on the home-buying process, you can reach home-buying success.

It is important to remember not to violate lender or homeowners insurance policies with your vacation home if you plan on renting it out. Also, remember that a vacation home can be a great investment. However, it will still require recurring costs, so make sure you have saved enough beforehand.

Before you buy your next home in North Carolina, feel free to contact one of our helpful real estate specialists, as they are eager to help you find the perfect home. We know that buying a home can be overwhelming, but a real estate agent can walk you through the entire process.