What Is An Encumbrance In Real Estate?

What is an encumbrance in real estate? Knowing how the property is encumbered is extremely important if you plan on buying a home. Follow along as we discuss what an encumbrance is and how it can cause restrictions.

Buying a home can come with limits on what you, as the owner, can do with the property. These limits are known as encumbrances and can be beneficial or disadvantageous. Common encumbrances against real property include liens, easements, leases, mortgages, or restrictive covenants. While they limit what you can do with the property, encumbrances also impact the transferability of the property.

We're going to do a deep dive into what an encumbrance is, how the different types can affect the property, and more. Let's get started!

1. What Is An Encumbrance?

"An encumbrance is an interest or right held by a third party that encumbers - impedes, hinders or burdens - the function or activity of something (like a property) or some transaction (like a real estate sale)."

An encumbrance is defined as a claim against an asset by an entity that is not the owner. The claim is brought up by a party who is not the owner and limits what an owner can do with the property. An encumbrance can also create a cloud on a title of real property. A cloud on a title is a phrase used to refer collectively to any of the types of title defects that a title search can uncover. This includes any encumbrance that interferes with a clean transfer of title from seller to buyer. Beneficial encumbrances include zoning laws that prevent homes in an area from being used for commercial purposes. Troublesome encumbrances include liens placed on a property that seek repayment of debt.

Encumbrances also affect the marketability of security: an easement or a lien can make a title unmarketable. This does not mean that the title cannot be bought or sold, but it does allow the buyer to back out of a transaction, despite having signed a contract.

Before we dive in, here are a few examples of how an encumbrance can affect a property, according to rockethomes:

- A lease will put limits on what you're able to do with the property

- An involuntary lien can impact the sale of a home

- Local zoning laws can limit your ability to make updates to your home

- An encroachment can lower the value of the property

- An easement could give another person the right to access or make changes to your property

2. Types of Encumbrances

As said before, common types of encumbrances include liens, easements, leases, mortgages, or restrictive covenants. These can be categorized into legal encumbrances and financial encumbrances. Let's discuss them!

Legal Encumbrances

Legal encumbrances are created by the operation of law, like environmental regulations or zoning laws. They restrict the use of the property, and homebuyers are encouraged to do their research on the types of legal encumbrances before purchasing a home. Zoning laws refer to specific rules and regulations for pieces of land divided into "zones" by other governments or municipalities. They dictate acceptable methods of land use for real property inside zoning districts.

Essentially, zoning laws determine which types of properties can coexist in different areas of the city. They can restrict you from building certain structures on your property, like an accessory dwelling unit, without permission. Zoning laws can also limit the types of water, septic, or power systems your property can utilize if they don't comply with environmental regulations. There are different types of zoning laws:

Residential: residential zoning laws apply to single-family homes, condos, apartments, duplexes, and manufactured homes

Commercial: commercial use zoning laws apply to office buildings, hotels, warehouses, shopping areas, and real property, including ponds or roads. Zoning laws can regulate the proximity of certain businesses or even ban types of businesses.

Mixed-use: Mixed-use zones refer to an area with a combination of housing, commercial properties, and retail stores.

Financial Encumbrances

Financial encumbrances often transfer with the property, so it's essential to ensure they are cleared before you buy the property. Financial encumbrances also make it more difficult to sell and less appealing to buy.

Liens are the most common type of financial encumbrance that can be imposed on a property. A lien refers to a legal claim against property that can be used as collateral to repay debt. Liens can either be attached to real property, such as a home, or personal property, such as a car or furniture. When talking about encumbrances, liens will be placed on the property. The two most common types of liens are mortgage liens and mechanic's liens.

A mortgage lien enables you to afford a house over time instead of paying for the entire cost upfront in cash. With a mortgage lien, your house is used as collateral until you pay the loan off, but it won't be affected if your mortgage payments are made on time. If you cannot make your mortgage payments, your lender may foreclose, seizing the house as collateral and evicting the inhabitants.

Builders, contractors, and construction firms use a mechanic's lien to afford building or repair structures. Mechanics liens ensure the workman gets paid for their job, and if they don't, they'll file a mechanics lien on your property. A mechanics lien is a claim for payment for work done to repair or improve your property.

Tax liens are also placed on property to force the payment of taxes. A federal tax lien would trump all other claims on a debtor's assets, even if it was filed later on.

Easements

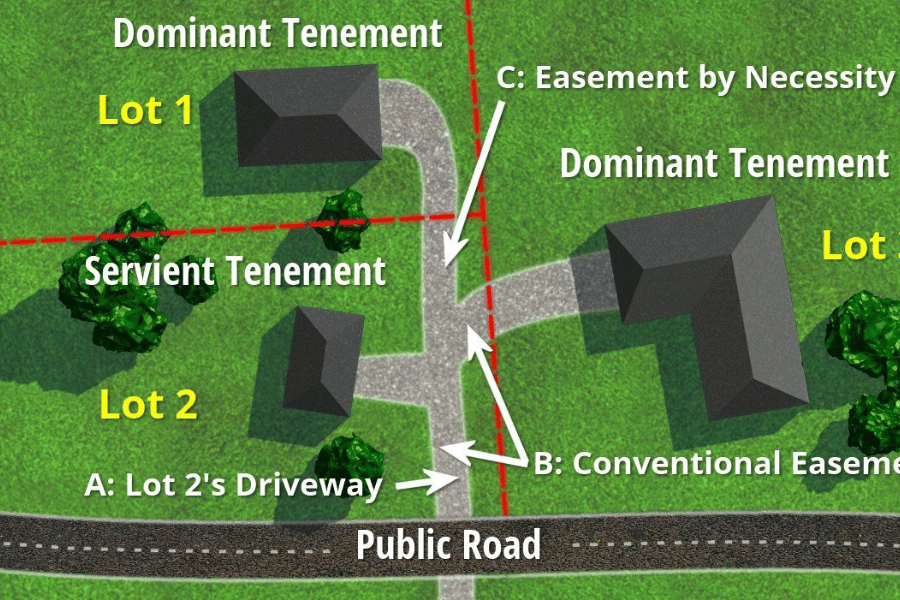

An easement is defined as the right to use land belonging to another. Easements are the grant of a nonpossessory property interest that grants the easement holder permission to use another person's land. If there's an easement held on your property by an individual or entity, that party has the right to access your property within the guidelines set by the easement.

A utility easement is created by state or local law to give utility companies the right to access the property. Utility easements are important to ensure your property has running water, electricity, cable & sewer systems, etc.

Easement by necessity is another type and is used when another individual must access your property. For example, if your neighbor is landlocked and can only access the road by crossing your property.

Prescriptive easements grant rights to someone who doesn't own the property. It is created because the non-owner has already been using the property in a hostile, open, and notorious manner for a period of time as defined by the laws of the property's state.

An easement in gross benefits an individual rather than an owner of a property so that your neighbor might have access to use your water well, but that right would not pass on to someone who purchases your neighbor's property.

Lease

A lease is defined as an agreement to rent a property for an agreed-upon rate and period of time. It is a form of encumbrance because the lessor, or landlord, does not give up title to the property, but their use of the property is constrained by the lease agreement.

Restrictive Covenants

A restrictive covenant is an agreement to either take or refrain from taking a specific action on a property. Restrictive covenants are most common in neighborhoods run by a homeowner's association. Restrictive covenants include what you cant do with your property, like raising livestock. They also include things you must do, like regularly mowing your lawn.

Deed restrictions can also be written into the deed and passed down from owner to owner. For example, a deed restriction can limit a future owner by placing restrictions on a deed or entering into a restrictive covenant with neighbors.

Encroachments

An encroachment occurs when one property owner violates their neighbor's rights by building or extending some feature and crossing onto their neighbor's property line. Encroachments can include building a fence over the property line or a structural addition extending beyond the legal property boundaries. Encroachments can be intentional or unintentional, but both lead to liability issues, property damage, or even problems at the time of sale.

3. Should I Buy An Encumbered Property

You shouldn't walk away from an encumbered property without first understanding what the encumbrance means and how it will encumber you. Many encumbrances are implemented to protect the property's value and make certain things more convenient for everyone involved. Zoning regulations are not the biggest deal and may not bother you, but problems may arise if there's an IRS lien or a property tax lien on the home.

Financial encumbrances can create obstacles for both the home buyers and sellers, like extra expenses or blocked closing. When buying a property, you want to make sure that there isn't anything clouding the title. To protect yourself, you can request a general warranty deed. This type of warranty guarantees there is no encumbrance against the property other than those stated in the deed.

4. How To Find An Encumbrance

A title search is the best way to learn if there is an encumbrance on your property. A title search examines public records on the property to confirm the property's rightful legal owner and reveals if any claims or liens on the property could affect your purchase. Encumbrances such as unpaid property taxes, homeowner's association fees, and bills for past home improvements might become your responsibility if you skip a title search.

After your title search is conducted, you'll want to get title insurance. Title insurance is a policy meant to protect home buyers and mortgage lenders from damages and financial losses caused by a bad title due to title defects. Title insurance covers all common claims against a title, including outstanding liens, back taxes, and conflicting wills.

5. Key Takeaways

- An encumbrance is a third party's right or interest in a property and can be included in the property deed or title

- The most common types of encumbrance include liens, deed restrictions, easements, encroachments, restrictive covenants, etc.

- Liens and easements give another party a claim to or right to use your property.

6. FAQ

What is an example of an encumbrance?

Any lien or claim on a property is an encumbrance, including a mortgage, zoning laws, and environmental restrictions.

What is the difference between a lien and an encumbrance?

A lien is a legal right or interest of a creditor in the property of another and usually last until a debt or duty is satisfied. An encumbrance is a claim or liability attached to the property.

How can I remove an encumbrance from a title?

You can remove an encumbrance by filing a petition for cancellation of encumbrance under Section 4, Rule 74 of the rules of court with the register of deeds where the property is located.

What Is An Encumbrance In Real Estate - Final Thoughts

An encumbrance is a limit on how an owner can use their property and is placed on the property itself, not the owner. It is very common for nearly every property to have at least one encumbrance on it, so it's important to understand exactly what that means. There are both legal encumbrances and financial encumbrances that affect your property use differently. Legal encumbrances include zoning laws, and financial encumbrances include liens and leases. It's also important to understand that not every encumbrance is bad, so just because you see your property has one doesn't mean you need to walk away from a sale.

Raleigh Realty is a local real estate company specializing in home buying and selling. We have an extensive list of Real Estate Agents that are willing and ready to help you find your dream home while assisting in finding out if the property is encumbered! Contact us or visit our website for more information.

If you found our resource on Encumbrances useful, feel free to share it with friends and family!