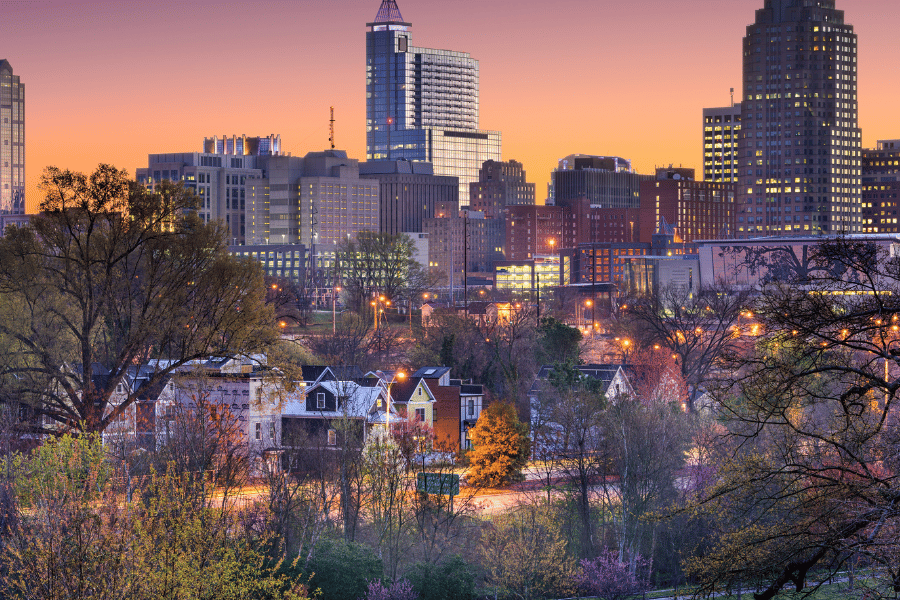

Top Raleigh Areas For Investment Properties

Where are the best areas in Raleigh for investment properties? Here is all you need to know about properties in Raleigh and where to invest.

Raleigh, NC, is an increasingly popular real estate market that has been experiencing significant growth. As a potential investor, you have the opportunity to benefit from this growth by purchasing single and multi-family homes in Raleigh, especially now with affordable rental housing.

Raleigh continues to be one of North Carolina's most attractive markets for real estate investment, combining steady population growth, a thriving job market, and diverse neighborhoods that appeal to various tenant demographics.

The city's thriving economy and the relocation of numerous technology and biotechnology industries have attracted many professionals to the area. The real estate market is expected to continue growing, with more than 50,000 new residents projected to move here within the next five years. As the population increases, the area will have a larger pool of employees.

The Triangle is the second-fastest growing tech hub in the US, with 4,000 tech companies employing more than 60,000 people in software development, information security, and everything in between. This concentration of high-paying technology jobs creates a robust tenant base willing and able to pay premium rents.

Investing in real estate offers numerous benefits and is relatively straightforward and accessible to almost anyone. Starting early can help you build your portfolio and create wealth regardless of your age, income, or other factors. The real estate market tends to be less volatile than the stock market, making it an attractive investment option.

Here are the seven top Raleigh areas that savvy investors should consider for their next investment property purchase.

Check out these top areas in Raleigh for investment properties.

1. Glenwood South

Glenwood South stands as one of Raleigh's premier entertainment and dining districts, making it a magnetic draw for young professionals and urban dwellers. This vibrant neighborhood offers the perfect blend of nightlife, cultural attractions, and walkable convenience that today's renters crave.

Investors who buy real estate in Glenwood tend to target a younger demographic. This neighborhood boasts trendy bars, cool breweries, and diverse restaurants. Glenwood is an area in ongoing development, with new homes and businesses catering to young professionals and students.

Real estate in the Glenwood area is mainly owner-occupied, but investment opportunities exist in condos, townhomes, and converted properties. Properties here typically command premium rents due to the desirable location and amenities.

The consistent demand from young professionals, medical residents, and graduate students creates a stable rental market. The area's continued development and urban revitalization efforts suggest strong long-term appreciation potential.

2. Mordecai Historic District

The Mordecai neighborhood represents one of Raleigh's most charming historic districts, offering investors the opportunity to own properties with character and architectural significance while benefiting from the area's ongoing revitalization.

As one of Raleigh's oldest neighborhoods, Mordecai has historic homes and beautiful tree-lined streets showing off its charm. While Mordecai is considered small compared to other neighborhoods throughout Raleigh, investors find properties here to be charming, with many opportunities for renovations.

One of the main selling factors for Mordecai is its short distance to the city. Families, as well as working professionals, are attracted to this location for its convenience, serene environment, and rich history.

This neighborhood features a diverse mix of historic homes, ranging from restored Victorian-era houses to early 20th-century bungalows. Properties here offer excellent potential for both traditional rentals and short-term vacation rentals due to the historic appeal.

Residents enjoy proximity to downtown Raleigh, easy access to major highways, and a growing selection of local businesses along Capital Boulevard. The area also offers several parks and green spaces.

3. The Village District

The Village District, once referred to as Cameron Village, is a mixed-use neighborhood with a blend of residential and commercial properties. With its high walkability and variety of amenities, it is a popular area to call home in Raleigh.

If you are looking for a more affordable investment, The Village District is the market to look in. Offering a variety of investment properties, such as single-family homes, ranch-style houses, and commercial buildings, you can find what you want that fits your budget here.

Just a short drive from downtown, The Village District offers many amenities that many families and young professionals look for. The easy access to multiple shops, bars, and restaurants makes this a great location for people searching for an urban-type feel with a cozy atmosphere.

The Village District is a great place for young professionals with bustling social lives because almost anything you need is within walking distance. Located on the western side of downtown, this location has some of the best restaurants, shopping centers, brunches, and other amenities.

Real estate in the Village District features various styles, from ranch-style to historic properties. This is a popular destination for young adults looking to be located near the college and things to do. However, it is also a perfect place to settle down.

4. Brier Creek

Brier Creek represents one of Raleigh's most successful planned communities, offering investors access to a mature, amenity-rich suburb with strong rental demand and steady appreciation. Its location close to Research Triangle Park makes it a popular area for technology investors.

The area features a mix of single-family homes, townhomes, and apartments, with price points that attract both first-time buyers and experienced renters. Properties range from starter homes to luxury residences, providing investment options for various budgets.

If you're interested in discovering new property developments, Brier Creek might be the perfect place for you. This neighborhood is well-known for attracting young professionals, older adults, and families. It is highly sought after in Wake County due to its highly-rated public schools.

If you are looking for a centrally located neighborhood that is in the heart of it all, then searching for homes for sale in Brier Creek may be perfect for you.

5. Five Points

Five Points is aptly named for being the central link to 5 historic neighborhoods. Investors can choose to buy properties in Bloomsbury, Roanoke Park, Vanguard Park, Georgetown or Hayes Barton. This collection of prestigious neighborhoods offers some of Raleigh's most sought-after investment opportunities.

Developed late 1910s through 1950s, these neighborhoods feature some of Raleigh's most beautiful and well-preserved historic architecture. The areas showcase various architectural styles from Tudor Revival to Colonial Revival.

Properties in these neighborhoods range from charming bungalows to stately manor homes, many sitting on tree-lined streets with mature landscaping. The architectural diversity and historic character create unique rental opportunities for discerning tenants.

These neighborhoods consistently rank among Raleigh's most desirable addresses, attracting professionals, executives, and families who appreciate quality, location, and prestige. This demographic typically pays premium rents and maintains properties well.

While entry costs may be higher, the prestige factor and limited inventory in these established neighborhoods often lead to strong appreciation and rental stability. Properties here are particularly attractive for investors targeting the luxury rental market.

.png)

6. Historic Oakwood

Historic Oakwood represents one of Raleigh's most successful urban revitalization stories, transforming from a neglected area to one of the city's most sought-after neighborhoods for urban professionals.

Its biggest draw is its location in downtown Raleigh. This proximity makes it particularly attractive to professionals working in downtown's growing business district.

The ideal target market of Historic Oakwood are sophisticated professionals who aim to be near their workplaces downtown. Families would also enjoy the sense of community that Historic Oakwood extends to residents.

The combination of historic charm, downtown proximity, and strong community identity creates a stable, high-demand rental market with excellent long-term appreciation prospects.

7. Southeast Raleigh

In 2025, Southeast Raleigh is one of the best neighborhoods to buy investment properties. This designation from recent market analysis highlights the area's growing investment appeal.

As one of Raleigh's emerging areas, Southeast Raleigh offers investors the opportunity to get in on development trends. The area's proximity to downtown and major employment centers positions it well for future growth.

Southeast Raleigh benefits from this strong rental market while offering more affordable entry points than established neighborhoods. This area is ideal for investors comfortable with emerging markets who seek higher potential returns.

Methodology

Data was sourced from the U.S. Census Bureau, WRAL Tech Wire, and Fannie Mae to determine the best places in Raleigh, NC, for investment properties.

FAQs

Is Raleigh a good place for an investment property?

Raleigh has proven to be a great place for investors looking to invest long-term in the real estate market. The growing city offers many things, especially a high quality of life and job opportunities, making it a great place to live.

Is the housing market in Raleigh good for an investment?

Raleigh's population is growing rapidly, with about 60 new residents arriving daily. Many people are moving to the area due to its robust housing market and rental opportunities, which can provide a high return on investment.

Why is real estate such a good investment?

On its own, real estate offers many benefits, such as cash flow, tax breaks, equity building, competitive risk-adjusted returns, and a hedge against inflation. There are many other ways why real estate is such a good investment, so if you are interested in doing so, start doing your research now.

Top Raleigh Areas For Investment Properties - The Bottom Line

Raleigh is a great place to live and a highly sought-after area in North Carolina, which is why it is a great place for investors. With downtown Raleigh and the surrounding suburbs, each area offers locals a high quality of life and new future developments.

North Carolina overall has many diverse real estate investment opportunities if you are looking to buy or sell rental properties. From Raleigh's downtown area to its charming historic neighborhoods, there is something for every investor. Whether you are looking for rental properties, long-term investment, short-term, or property appreciation, Raleigh has it.

When selecting an investment property in Raleigh, consider your investment strategy, risk tolerance, and target tenant demographic. Evaluate the local housing market, home prices, and interest rates.

Historic neighborhoods like Five Points and Historic Oakwood offer prestige and stability but require higher initial investments. Emerging areas like Southeast Raleigh provide growth potential but may involve more risk. Established suburban areas like Brier Creek offer steady, predictable returns ideal for conservative investors.

Each of these seven neighborhoods offers unique advantages that can align with different investment strategies and financial goals. If you are considering a move to Raleigh, contact the experts at Raleigh Realty.