How To Sell a Raleigh Home After a Death in the Family

Are you selling an inherited home in Raleigh, NC? Here is what you need to know about selling a house in Raleigh after a death in the family.

Losing a loved one is one of life's most difficult experiences. The last thing you want to deal with during this time is the stress of selling their home in Raleigh. Yet many families in Raleigh and Wake County find themselves in exactly this situation, inheriting a property that brings both strong emotions and challenges.

Whether you are the executor of an estate, making decisions with siblings, or simply trying to settle your loved one's affairs, selling an inherited home involves unique considerations that differ significantly from a traditional home sale.

The good news is that you have more options than you might think, and many families are discovering that alternative sales methods can offer a faster and less stressful path forward than a traditional listing.

Let's walk through everything there is to know about selling a Raleigh home after a death in your family.

1. Understanding the Probate Process in North Carolina

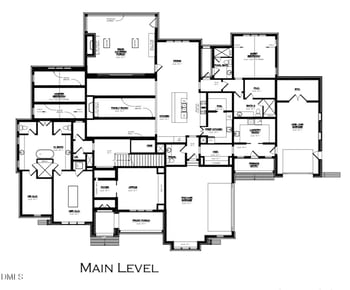

Before you can sell an inherited property in Wake County, you will typically need to navigate North Carolina's probate process. Probate is the legal procedure that validates a will and authorizes the executor to distribute assets, including real estate.

The probate process includes filing the will with the Clerk of the Superior Court, appointing a personal representative to manage the estate, gathering and inventorying assets, notifying creditors, paying debts and taxes, distributing remaining assets to beneficiaries, and ending with a final accounting and closing of the estate.

In North Carolina, this process typically takes 9 to 12 months for straightforward estates, though complex situations can extend this timeline. The executor (person named in a will) must be officially appointed by the Clerk of Superior Court before they can legally sell estate property. In Wake County, this process begins at the Wake County Courthouse.

There are some situations where probate may be avoided entirely. If the property was held in joint tenancy with right of survivorship, had a transfer-on-death deed, or was placed in a trust, it may bypass probate.

Additionally, depending on the will's language and estate value, you may need court approval before selling. An experienced probate attorney can clarify your specific requirements and help you understand which rules apply to your situation.

Most executors find that consulting with a local probate attorney early in the process saves considerable time and prevents costly mistakes down the road. Keep in mind that during this process, there are court filing fees, including the percentage of the estate's value plus potential attorney fees.

.png)

2. Common Challenges When Selling an Inherited Home

Selling an estate property comes with unique obstacles that traditional home sellers rarely face. One of the most common challenges involves multiple decision makers. When siblings or multiple heirs are involved, it can be difficult to agree on the sale price, timing, and whether to invest in improvements.

Property condition is another frequent issue. Many inherited homes have not been updated in years, and the property might need significant repairs to appeal to buyers. Common issues in older homes might include outdated electrical systems, original HVAC units, aging roofs, and cosmetic updates.

The emotional impact of managing an estate sale can take its toll. Sorting through a lifetime of belongings, making decisions about cherished items, and preparing the home for sale while grieving can be emotionally exhausting for many families. Many executors find themselves overwhelmed by the number of decisions that need to be made during an already difficult time.

Carrying costs are also known to add financial pressure to the situation. While you are dealing with probate and preparing the home for sale, you are also paying property taxes, insurance, utilities, and potentially HOA fees. These costs add up quickly, particularly if the sale process extends over many months.

When out-of-state heirs are involved, this creates additional complications. Many estate sales involve heirs who live hours away or out of state entirely, making it difficult to manage contractors, stage the home, or handle showings. Coordinating trips to the area becomes a significant burden.

Finally, market timing pressure affects many families. Some face financial pressure to sell quickly to cover estate taxes, pay off the deceased's debts, or simply distribute inheritance to heirs who need the funds. This pressure can lead to hasty decisions or settling for less favorable terms.

3. Option 1: Traditional MLS Listing

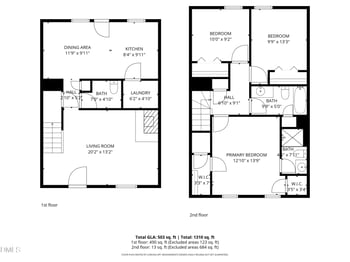

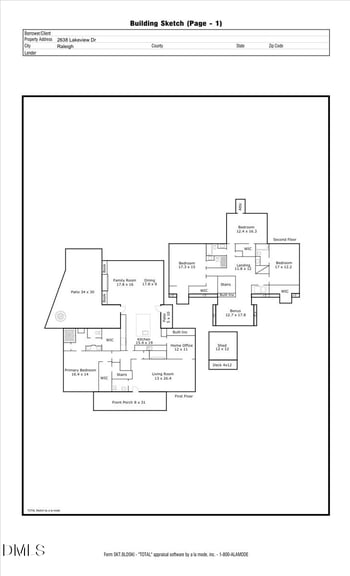

When selling an inherited Raleigh home, you have several paths forward. Understanding each option helps you make the choice that best fits your family's situation. The most traditional option is to hire a real estate agent, list the home on the MLS, make it show-ready, and wait for buyers.

This approach is best for updated homes in desirable Raleigh neighborhoods like North Hills, Brier Creek, or downtown areas, where you can command top dollar. However, there are important considerations when selling an inherited home.

In this case, you will likely need to invest in repairs, deep cleaning, staging, and possibly updates to compete with other listings. For a home that needs significant work, these upfront investments can be substantial, and there is no guarantee the market will reward your investment.

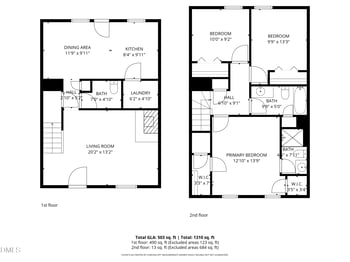

4. Option 2: Selling As-Is to a Cash Buyer

This option involves selling to an individual investor or institutional cash buyer who purchases homes in any condition. Going this route is best for homes that need moderate repairs, where you want a faster sale than the traditional home market but at a lower price.

Cash buyers typically offer 70% to 85% of market value to account for repairs and their profit margin. The speed and convenience come at a discount, which may or may not make sense for your situation. This route works well when time is the priority, and the property does not have significant land value that might appeal to builders.

5. Option 3: Selling As-Is to a Builder for Lot Value

Selling as-is to a builder for lot value is an often-overlooked option that can be ideal for inherited properties, particularly older homes in desirable locations. Instead of selling to a homebuyer who wants to live in the property, you are selling to a builder who values the land and location, not the structure.

In this instance, builders in growing neighborhoods actively seek lots where they can tear down outdated homes and build new construction. They evaluate the property based on lot size, location, zoning, and the potential resale value of a new home they could build there.

This is a great option for older homes and is particularly attractive to property owners in areas where new construction is prevalent. In sought-after Raleigh neighborhoods, this option can also yield a higher return on investment compared to a traditional home sale, as you will not have to worry about paying for repairs or commissions.

There are many additional benefits associated with selling as-is to a builder for lot value. You are not required to make any repairs, updates, or staging investments; there are no showings to manage or open houses to host, the closing timeline is less than a traditional sale, and you are negotiating with one decision maker rather than multiple retail buyers.

6. What to Do With Personal Property and Belongings

One of the most emotional challenges during this time is dealing with the belongings inside the inherited home. This process requires practical decision-making, which can be hard when grieving.

The best place to start is by identifying items of monetary and sentimental value. This can include important documents, jewelry, collectibles, family heirlooms, and valuable artwork, which should be set aside first. If multiple heirs are involved, have an early conversation about who wants what to avoid conflicts.

For items that have value but no one in the family wants, estate sale companies can handle the entire process of pricing, advertising, and selling items from the home. Alternatively, you might consign higher-value items or sell them through online marketplaces.

For usable items that do not have significant resale value, donation is an excellent choice. Organizations like Habitat for Humanity ReStore, Goodwill, and local churches will often arrange pickup for furniture and household goods. Items that can not be sold or donated will need to be disposed of.

The timeline for this process varies widely and often depends on the number of belongings to go through. Some families complete a cleanout within a weekend, while others take months to sort through belongings and all of the memories associated with them. Allow yourself permission to move at whatever pace feels right and recognize that moving forward with the sale is part of the healing process.

7. Tax Implications of Selling an Inherited Property

Understanding the tax consequences of selling an inherited home helps you make informed decisions and avoid surprises at tax time. While this can feel complicated, the good news is that inherited property receives favorable tax treatment in most cases.

Selling an inherited property primarily triggers capital gains tax on the appreciation after you inherit it, thanks to a "stepped-up basis" to the fair market value at the date of the owner's death. This means that taxes will be significantly reduced if the home is sold quickly.

Capital gains tax rates depend on how long you hold the property before selling. Any inherited property is automatically treated as long-term, regardless of how quickly you sell, which means that you will be paying long-term capital gains rates rather than higher short-term rates.

If you live in the inherited home as your primary residence for at least two of the five years before selling, you may qualify for the primary residence exclusion. This allows you to exclude up to $250,000 if single or $500,000 is married and filing jointly. This can be valuable if you are considering moving into the home temporarily.

Property taxes continue accruing while you own the inherited home, and these become the estate's responsibility. In Wake County, property taxes are due September 1st, with payments accepted without interest through January 5th of the following year. If your loved one prepaid taxes or if taxes are prorated at closing, these will be settled through the closing process.

.png)

Methodology

Data was sourced from the IRS, Fidelity, MetLife, and the North Carolina Judicial Branch to determine how to sell an inherited home in Raleigh, NC.

FAQs

How do I avoid paying capital gains tax on inherited property in North Carolina?

To avoid paying capital gains tax on inherited property in NC, you can use the "step-up basis" rule by selling quickly at the fair market value at inheritance, moving in and using the $250,000/$500,000 primary residence exclusion, or using a 1031 exchange for investment properties to defer tax.

What is the first thing you do when you inherit a house?

When you inherit the house, the first thing that you need to do is contact the executor and secure the property. From there, you will need to address the financial and insurance needs immediately, such as paying ongoing bills and updating the homeowner's insurance policy.

Is it better to keep an inherited house or sell it?

Deciding whether to keep an inherited property or sell it depends entirely on your personal financial situation, emotional attachment to the home, and long-term goals. Selling is often the most common choice, especially if you live far away.

Selling an Inherited Property in Raleigh, NC - Final Thoughts

Selling a home after a death in the family is never easy, but understanding your options is crucial to removing much of the stress and uncertainty from the process. While the traditional listing route works well for many families, selling as-is to a buyer is a popular alternative, especially if the home will need significant updates.

At Raleigh Realty, we are happy to help you navigate this challenging time with compassion and expertise in the Raleigh area. If you are ready to explore your options, contact the experts at Raleigh Realty today to get started.

![How To Sell an Inherited Home in Raleigh, NC [2026 Guide]](https://raleighrealty.com/rr-images/uploads/blogs/1768947894285-754962438-Sell-Inherited-Home-Raleigh,-NC.png)