Buying a Fixer Upper

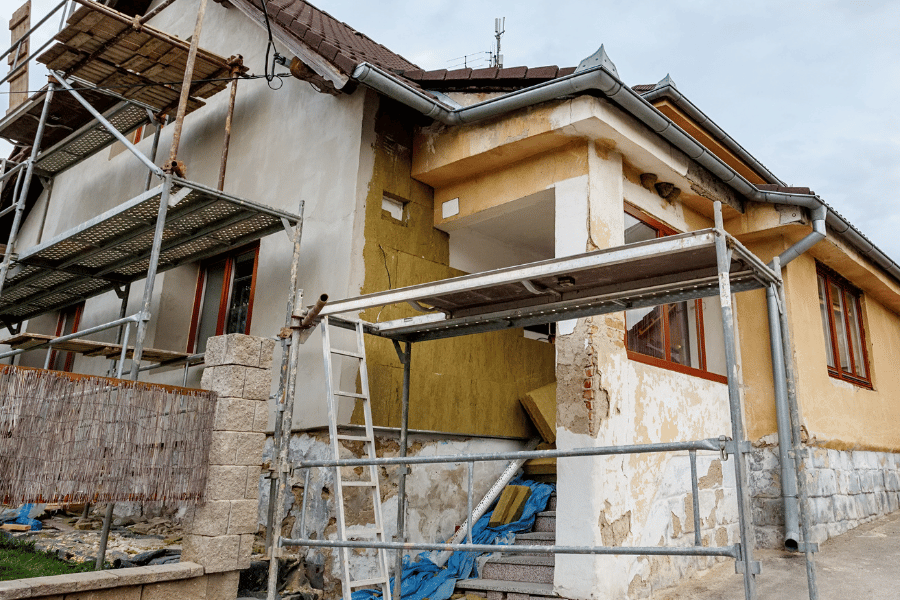

Are you moving to the Triangle area and wondering if that charming but dated home is your ticket to homeownership? Here's everything you need to know about buying fixer-uppers in Raleigh's competitive market.

Buying a house is a substantial financial decision and a real estate investment. However, if you are willing to put in extra work on a home known as a "fixer-upper" at a below-market price, then this is for you.

Buying a fixer-upper house is a serious investment, as you must be fully committed before you begin. Every day, more consumers are considering buying a home that is not move-in-ready to save more money.

With median home prices in Wake County rising faster than many newcomers expected, fixer-uppers have emerged as an increasingly popular path to homeownership in desirable neighborhoods that might otherwise be financially out of reach.

A fixer-upper home is a lot more expensive than a move-in-ready home, but you also have to consider the cost of renovations and repairs. There are professionals out there who can help you find the value in choosing the right projects.

From navigating North Carolina's specific building codes to working with contractors who are booked months in advance, successful fixer-upper purchases require careful planning, realistic budgeting, and honest self-assessment of your capabilities and circumstances.

Whether you're a first-time homebuyer or an experienced investor eyeing opportunities in Raleigh's real estate market, this guide will help you make an informed decision about whether a fixer-upper aligns with your goals, timeline, and stress tolerance.

Here is what you should know about buying a fixer-upper.

1. What Exactly Is a Fixer Upper?

A fixer-upper is a property that requires significant repairs, updates, or renovations before it can be considered move-in ready. Unlike homes needing minor cosmetic touches like fresh paint or new carpet, true fixer-uppers typically have issues with major systems (plumbing, electrical, HVAC), structural problems, or severely outdated features that affect both safety and livability.

Some people benefit more from a fixer-upper, as many individuals use it as a business opportunity to renovate and sell the house for profit. Fixer-uppers can also be considered starter homes, especially in today's expensive and competitive real estate market, where it's challenging for some buyers to purchase a property.

The spectrum of fixer-uppers ranges widely, from properties needing mainly cosmetic updates to those requiring complete gut renovations. Understanding where a property falls on this spectrum is crucial for budgeting and timeline planning.

Unlike other properties, fixer-uppers require immediate investment beyond typical homeowner maintenance, often making them difficult to finance with conventional mortgages. Many also require permits for the necessary work, and some may not be insurable in their current condition.

2. Tips For Buying A Fixer-Upper

Successfully purchasing and renovating a fixer-upper in Raleigh requires understanding both the general principles of renovation projects and the specific challenges of working in the Triangle area's unique market conditions.

Understand Future Growth Patterns

Pay attention to future development plans that could affect property values. Proximity to planned transit routes, new schools, or commercial development can dramatically impact your renovation return on investment.

On the other hand, areas planned for industrial development or major road construction might not appreciate as expected. The city's comprehensive plan and Wake County's growth projections provide valuable insight into which neighborhoods are positioned for long-term value growth.

Budget Accordingly

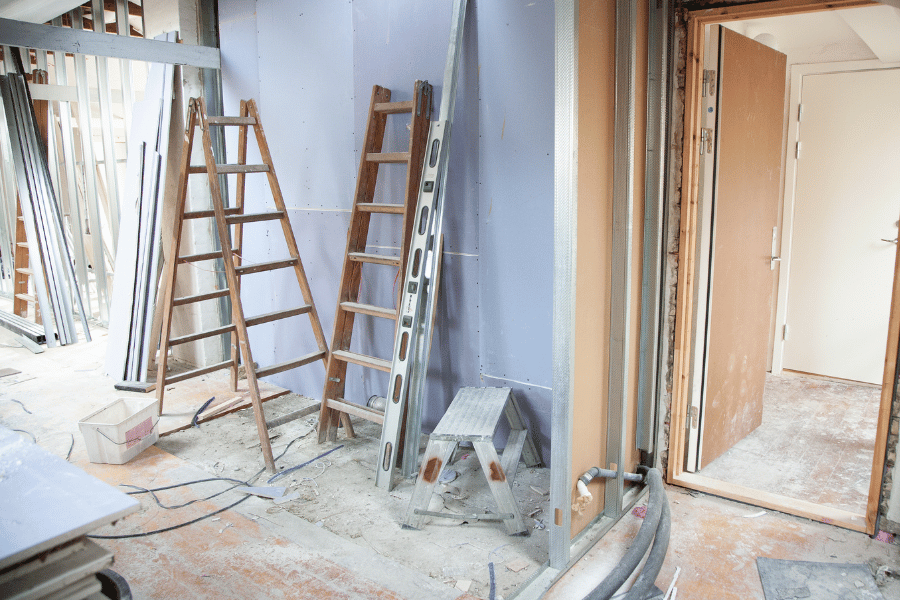

Planning and knowing how much you can afford is crucial when you buy a fixer-upper. Renovating a home takes a lot of time and money, so budgeting and creating a plan help expand the project. They tend to recommend adding an extra 20% to your general home-buying budget.

Also, you need to prepare for all the repairs and renovations you will do yourself, as well as any professional help you may need, such as plumbing or electricians. Keep in mind that contractors may be backed up and can delay your work, so planning and having your work in advance will help.

Factor in Climate Changes and Building Requirements

North Carolina's subtropical climate creates specific challenges that Northern transplants might not anticipate. Budget extra for moisture control systems, proper insulation that handles both summer heat and winter cold, and HVAC systems sized appropriately for high humidity conditions.

Your renovation should include storm-resistant features like proper window protection, secure roofing materials, and adequate drainage systems. Factor these requirements into your budget from the beginning rather than discovering them during permitting.

Get Multiple Professional Inspections

Beyond a standard home inspection, the Triangle area's specific geological and climate conditions make specialized evaluations essential. Many homes built before 1960 may have electrical systems that not only need updating but may not be adequate for modern electrical loads.

Consider specialized evaluations for:

- Foundation and structural assessment: Clay soil expansion and contraction can cause ongoing foundation movement

- Electrical systems evaluation: Older homes may have inadequate service panels, outdated wiring, or code violations

- Plumbing inspection: Cast iron pipes common in older homes may need complete replacement

- HVAC assessment: Systems must handle high humidity and may require upgraded ductwork

- Environmental testing: Asbestos and lead paint are common in pre-1978 construction

- Pest inspection: Termites and moisture-related pest issues are common in the Southeast

Understand Permit Requirements

Wake County and the City of Raleigh have specific permitting processes that can add weeks or months to projects. Major renovations typically require building permits, and electrical and plumbing work requires separate permits and inspections.

Some neighborhoods have additional HOA requirements, and historic districts have their own approval processes that can take 30-60 days before work can even begin. Even some seemingly minor updates, like adding electrical outlets or moving walls, require permits and inspections.

3. How To Buy A Fixer-Upper

Purchasing a fixer-upper requires a more complex process than buying a traditional home, with additional considerations at every stage from financing to closing. Success depends on thorough preparation and understanding the unique challenges these properties present.

Finding a fixer-upper can be as simple as driving around a place and spotting homes that look in need. You can also look online with a real estate agent since they have access to the multiple listing services that the public doesn't.

Step 1: Secure Financing and understand Your Options

Traditional mortgages often won't cover fixer-uppers because lenders require properties to meet certain habitability and safety standards. Properties needing major repairs may not qualify for conventional financing, requiring specialized loan products or alternative approaches. On the plus side, fixer-uppers can save homebuyers up to 56% in the south and midwest.

Step 2: Build Your Professional Team

The difference between a successful fixer upper project and a costly disaster often comes down to having the right team in place before you start shopping for properties.

Assemble these professionals before you begin looking:

- Experienced real estate agent: Choose someone with specific fixer-upper experience who understands renovation financing, can estimate repair costs, and has contractor relationships.

- General contractor: Interview multiple contractors while you're not under pressure. Get references, verify licensing and insurance, and understand their scheduling and payment preferences. A good contractor can provide preliminary estimates and identify deal-breaking issues during your property search.

- Structural engineer: Essential for properties with foundation, framing, or other structural concerns. Having a relationship established means you can get quick assessments on properties under contract.

- Accountant or tax advisor: Renovation projects have complex tax implications, from deducting improvement costs to understanding depreciation rules for rental properties. Professional guidance can save thousands in taxes and help structure your purchase optimally.

- Insurance agent: Some properties may be difficult or expensive to insure during renovation. Understanding insurance requirements and costs upfront prevents surprises that could derail your project.

Step 3: Make Strategic Offers

Fixer-upper purchases often involve different negotiation strategies than traditional home buying. Sellers may be motivated by different factors, and your ability to close quickly or handle complex renovation financing may be more important than offering the highest price.

Step 4: Plan for the Unexpected

Even with thorough planning and professional inspections, renovation projects regularly encounter surprises that impact budgets and timelines. Successful fixer-upper owners plan for these inevitabilities rather than hoping they won't occur.

Develop contingency plans for common scenarios:

- Hidden structural issues: Budget for potential foundation repairs, structural modifications, or framing problems that aren't visible until walls are opened

- Code compliance surprises: Older homes may need expensive upgrades to meet current codes when permits are pulled for renovation work

- Timeline delays: Weather, permit delays, or contractor scheduling issues can push projects months beyond original timelines

- Supply chain disruptions: Specialty materials or custom items may have long lead times that delay project completion

- Living arrangement changes: Major renovations may take longer than expected, requiring extended alternative housing arrangements

4. Pros and Cons Of Buying A Fixer-Upper

Fixer-upper homes require a huge time commitment, but can also save you money. About 73% of people consider purchasing a fixer-upper since they tend to be more affordable. Buying a regular move-in house has many pros and cons, but there are also some you should consider with fixer-uppers.

Pros:

Lower Purchase Price: Fixer-uppers typically cost 10-30% less than comparable move-in ready homes, giving you access to desirable neighborhoods that might otherwise be unaffordable.

Customization Opportunities: Create your dream home exactly as you want it, from floor plan modifications to high-end finishes chosen within your budget.

Potential for Significant Equity: Smart renovations in good Raleigh neighborhoods can add substantial value, especially in areas experiencing gentrification or redevelopment.

Less Competition: Many buyers avoid fixer uppers, so you'll face fewer bidding wars and have more negotiating power.

Tax Benefits: Renovation expenses and mortgage interest on improvement loans may offer tax advantages. Energy-efficient upgrades might qualify for rebates from Duke Energy.

Learning Experience: Gain valuable knowledge about home maintenance and construction that will serve you well as a long-term homeowner.

Cons:

Upfront Capital Requirements: Even with renovation loans, you'll need significant cash for down payments, inspections, permits, and initial contractor payments.

Living Situation Challenges: Major renovations often mean living in construction zones, temporary housing costs, or extended stays with family and friends.

Project Management Stress: Coordinating multiple contractors, dealing with permit delays, and making countless design decisions can be overwhelming, especially while adjusting to a new city.

Potential for Cost Overruns: Renovation projects frequently exceed initial budgets by 20-50%, and timeline delays are common in Raleigh's busy construction market.

Financing Complications: Renovation loans have stricter requirements and more complex approval processes than traditional mortgages.

Resale Limitations: Over-improving for the neighborhood or making unusual design choices can limit your future buyer pool and return on investment.

Hidden Problem Risks: Older homes may have asbestos, lead paint, or structural issues that aren't apparent until work begins, potentially adding thousands to your budget.

5. Should You Buy A Fixer-Upper?

Buying a fixer-upper has become very popular in recent years. These types of properties make great investments and also allow you to have the freedom to create your own dream house. However, you need to remember that these projects cost money and time, so make sure you understand you can handle them before making the purchase.

The decision between a fixer-upper and a move-in-ready home involves more than just comparing purchase prices. Your choice should align with your financial situation, lifestyle preferences, risk tolerance, and long-term housing goals. Consider both the obvious factors and the subtle lifestyle impacts that can make or break your satisfaction with the decision.

Methodology

Data was sourced from the National Association of Realtors and the New York Post to determine if buying a fixer-upper is worth it.

FAQs

How to tell if a fixer-upper is worth it?

To make sure the fixer-upper house is worth the money, you need to look at comparable homes in the neighborhood. Then, you will add your estimated cost of renovations to that purchasing price. If you are making a profit on the house, then it is a good investment.

Is a fixer-upper a good investment?

Buying a fixer-upper is cheaper than buying a move-in-ready home. Since every house is unique and everyone wants or needs something different, it can be hard to say if a fixer-upper is a good investment for you specifically. If you are curious, you need to see if you have the time, money, and plan to take on this huge investment.

What should you avoid in a fixer-upper?

When you buy a fixer-upper, you should avoid not getting the full inspection done, falling in love with the house without considering all possibilities, assuming the best case when calculating costs and value, and taking on projects that require you to hire all professionals, since it will cost more, especially in the long run.

Is Buying a Fixer-Upper Worth It? - Final Thoughts

A fixer-upper can be a great investment, but it can also be a huge money pit if you do not estimate correctly and plan ahead of time. There is no such thing as a perfect fixer-upper because each property is different, so it is all up to you.

Consider your personal situation carefully. If you're relocating for work, have limited construction experience, or need housing stability immediately, a fixer-upper might add unnecessary stress to your move.

However, if you have renovation skills, flexible housing arrangements, and want to maximize your investment in one of Raleigh's desirable neighborhoods, a fixer-upper could be your path to homeownership and significant equity building.

Are you ready to explore fixer-upper opportunities in Raleigh? Contact Raleigh Realty today. Our experienced agents understand the local market and can help you evaluate properties.