Top Things To Consider When Buying a Home in Raleigh

Are you considering a move to Raleigh, NC? Here are the top ten things to think about before purchasing a Raleigh home.

Raleigh has emerged as one of the fastest-growing cities in the Southeast, and it's easy to see why. The City of Oaks combines Southern charm with modern conveniences, offering a unique blend of tree-lined neighborhoods, well-known technology companies, world-class universities, and a thriving cultural scene.

The Triangle's economy is booming and is home to major employers, including Red Hat, SAS Institute, Duke Energy, and three major universities. This economic diversity has created a stable job market that attracts professionals from across the country, contributing to Raleigh's reputation as one of the best places to live in North Carolina.

Attracting families, young professionals, and retirees to the area, Raleigh's real estate market is on the rise and has become increasingly competitive in recent years. Many homes in Raleigh often receive multiple offers and sell above the asking price.

The median home price has risen significantly over the past decade, though it remains more affordable than many comparable metropolitan areas. Whether you are a new homebuyer or a real estate investor, understanding the Raleigh real estate market and its many beautiful neighborhoods can feel overwhelming.

One of the most significant reasons some buyers walk away from a home purchase feeling remorseful is that they don't consider everything about purchasing real estate before they jump into it. We address common buyer mistakes upfront with all our buyers so they have a highly successful transaction.

Many people don't want to put in the upfront work, studying, and preparation to buy a house. Here are the top ten things every potential homebuyer should evaluate when searching for their perfect Raleigh home, each designed to help you make an informed buying decision.

Make these ten considerations before buying a home

1. Location and Commute

Location is by far the most essential part of buying real estate. The location of a house will have the most significant impact on its price and potential future appreciation.

One analogy we use to demonstrate how vital location is is this: If you take the least expensive home in the world and put it in downtown New York City, it is worth millions.

Raleigh's rapid growth means traffic patterns and commute times can vary dramatically depending on where you live and work. Please consider your daily travel needs when choosing a location.

If you work in Research Triangle Park, areas like Cary, Morrisville, or South Raleigh might offer shorter commutes. Neighborhoods like Glenwood South or the Village District provide fantastic walkability for downtown professionals.

.png)

2. School District Quality

If you are moving with children, Raleigh is a great place to search for homes since it is known for its many great schools. Wake County Public Schools consistently ranks among the top school systems in North Carolina, but individual schools can vary significantly in performance.

Research specific elementary, middle, and high schools serving your potential neighborhood, even if you don't have children. Strong school districts protect property values and attract quality neighbors.

3. Neighborhood Character and Amenities

The neighborhoods in the Raleigh area will play a large part in your home search. We recommend that our buyers focus on specific neighborhoods rather than cities or larger areas.

What are you looking for in a neighborhood? The neighborhood you live in will have a direct impact on you. Address this question early in the home-buying process because buying in the wrong neighborhood is a surefire way to be remorseful about purchasing a house.

Raleigh offers a mixture of diverse neighborhoods, from historic areas like Oakwood and Boylan Heights with their tree-lined streets and historic homes to new construction communities, including North Hills and Brier Creek.

Look for neighborhoods with active community associations, well-maintained common areas, walking trails, parks, and local gathering spots. Areas with established businesses, restaurants, and entertainment options tend to maintain their appeal over time.

4. Future Development and Growth

Raleigh's continued growth means today's quiet neighborhood could become tomorrow's busy residential area. Considered to have the 25th largest population increase in the country, Raleigh is getting bigger and better every year.

Research planned developments, road expansions, and zoning changes in the Raleigh suburbs and communities you are interested in.

Areas experiencing rapid development may see increased traffic and construction disruption in the short term but often benefit from improved infrastructure and amenities over time. Consider whether you prefer established neighborhoods or areas with massive growth potential.

5. Natural Disaster Preparedness

While Raleigh does not face the same hurricane risks as the cities and beaches along the coast, the area does experience severe thunderstorms, occasional tornadoes, and ice storms. Evaluate each home's vulnerability to weather-related damage and the neighborhood's drainage patterns.

Properties in flood-prone areas may require flood insurance, which will increase monthly costs. Check FEMA flood maps and ask about the home's history with weather-related damage. Well-maintained trees and good drainage can be valuable during severe weather.

6. Age and Condition of Home Systems

Anyone buying real estate should pay attention to the age and condition of a home. You do not want to buy a house with a crack in the foundation or a need for a new roof.

Raleigh's homes range from historic to brand-new construction, and they can have varying maintenance and repair needs.

Older homes offer character and established neighborhoods but may require updates in electrical, plumbing, HVAC, and roofing systems.

A home inspection can spot small and significant problems with the house, giving you far more negotiating power and a reasonable idea of what to expect regarding future expenses.

When evaluating different properties, consider the age of the roof, HVAC system, water heater, and major appliances. Budget for potential major system replacements, especially in homes over 15-20 years old.

.png)

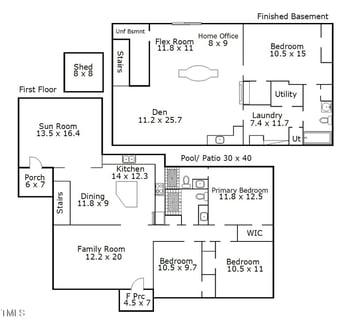

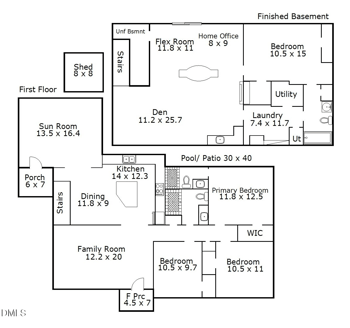

7. Storage and Space Requirements

As you begin your home search, you must set proper expectations for how much room you'll need. Is it a luxury home with plenty of space, or will it be a tight squeeze when you move all your stuff in?

North Carolina's climate allows for year-round outdoor activities, meaning many residents accumulate sports equipment, gardening tools, and seasonal items. Please look at each home's storage capacity, including garage space, basements, attics, and closets.

Many Raleigh homes feature unfinished basements that can provide excellent storage or future living space. Consider whether the home's current storage meets your needs or if you'll need to invest in additional solutions like shed installation or basement finishing.

8. Property Taxes and Municipal Services

Wake County property taxes fund excellent schools and services, but rates can significantly impact your monthly housing costs. Properties are reassessed every eight years, and Raleigh's rising property values mean tax bills have increased for many homeowners.

Research the specific tax rates for different municipalities within Wake County. Some areas have additional city taxes, while others operate as unincorporated county areas. Factor these ongoing costs into your budget alongside your mortgage payment.

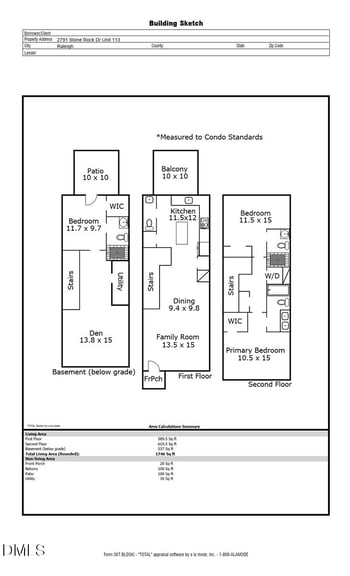

9. New Construction Homes vs. Resale

There are many differences between buying a new construction property vs. a resale home. Depending on the age, new homes have many added features that a resale property may not and should require much less maintenance.

New construction homes dominate areas like Southeast Raleigh, parts of North Raleigh, and surrounding communities like Fuquay-Varina and Knightdale, where builders rapidly develop former farmland and forest into master-planned communities.

On the other hand, resale homes often feature unique architectural details, hardwood floors, and established landscaping that would take decades to replicate in new construction. You'll know exactly what you're getting, can move in immediately, and often have more negotiating room on price and repairs.

New construction might suit you if you value modern conveniences and don't mind paying a premium for customization. If you prefer character, established neighborhoods, and better value per square foot, focus your search on resale properties in Raleigh's many desirable existing communities.

.png)

10. HOA vs. Non-HOA Properties

Homeowners associations can provide valuable services like landscaping, pool maintenance, and neighborhood security, but they also come with monthly or annual fees and restrictions on home modifications. It is important to note that not all HOAs are the same, and some will do very different things than others.

If you buy a house with an HOA, you must ensure you budget for it and can play by the rules. Some HOAs will not allow you to do certain things you may enjoy, which you could otherwise do without an HOA.

HOA fees in Raleigh typically range from $50 to $500+ per month, depending on the amenities offered. However, HOA fees vary by neighborhood and can depend on multiple factors, including the community size and location.

Many of Raleigh's newer subdivisions include HOAs, while older, established neighborhoods often operate without them. Consider your preference for community amenities versus individual freedom to do what you want with your property. Before purchasing, please review the HOA bylaws.

Methodology

Data was sourced from the U.S. Census Bureau, Bankrate, and the Office of the State Budget and Management to determine the top things to consider before buying a home in Raleigh, NC.

FAQs

Is Raleigh a good place to buy a home?

Raleigh, NC, offers many advantages to home buyers, making it a great place to live and own real estate. With a lower cost of living, affordable housing options, and a high quality of life, Raleigh is an ideal spot for first-time homebuyers.

What salary do you need to buy a house in Raleigh, NC?

To afford a home in North Carolina, it is reccommended to have an annual income of about $92,000. With a median household income of $82,424, buying a home in Raleigh is doable for most people living in the area. Homebuyers should not spend more than 30% of their income on housing.

What is the 20% rule when buying a house?

The 20% rule when buying a house states that a 20% downpayment is the traditional standard when purchasing a home. Since the down payment depends on the home you buy, a more expensive property will require a larger down payment.

.png)

Buying Real Estate in Raleigh, NC - Making Your Decision

Visit neighborhoods at different times of day and week to get an authentic feel for traffic patterns, noise levels, and community activity. Work with a knowledgeable local real estate agent who understands Raleigh's diverse neighborhoods and can help you navigate the competitive market.

Remember that no home will check every box perfectly. Prioritize your must-have features and be prepared to compromise on less essential items. With careful research and realistic expectations, you'll find a home that is a starting point in Raleigh, NC.

Are you ready to start your Raleigh home search? Contact our experienced local real estate specialists who know the Raleigh market inside and out. We are here to help you find the perfect home.

.png)