The North Carolina Home Buying Process

Are you considering buying a home in North Carolina? Here are the top eleven steps of the NC home-buying process!

Buying a home in North Carolina is an exciting journey but can also feel overwhelming without proper guidance. Whether you're a first-time buyer or returning to the market, understanding each step of the process will help you make informed decisions and avoid common pitfalls.

There is no "one size fits all" when it comes to the real estate closing process. Every state has different closing requirements, so closing on a home in North Carolina will be very different from closing in other states.

At Raleigh Realty, we've guided countless families through this process, and we're here to break down the eleven crucial steps that will lead you to your dream home.

Here is what you need to know about the NC home buying process.

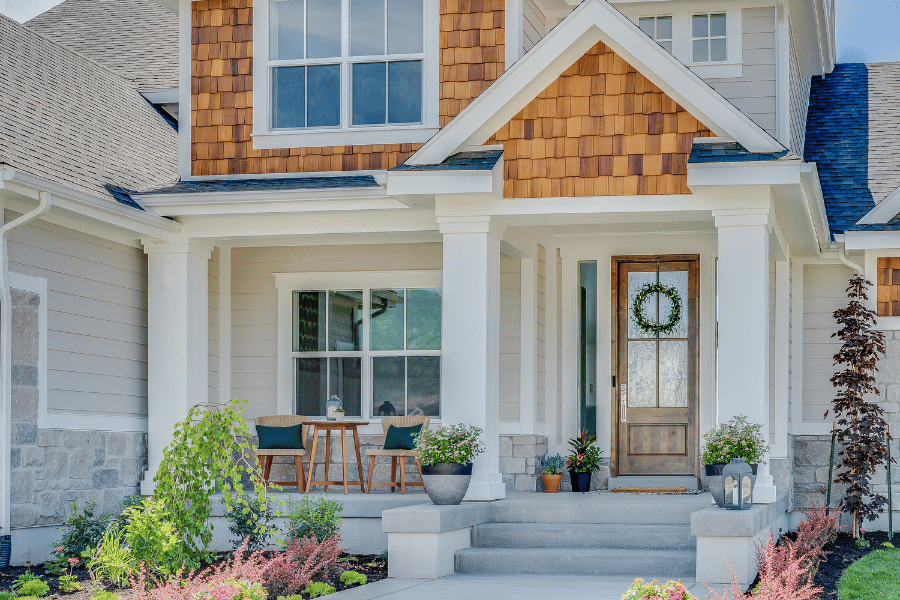

1. Determine What You're Looking For in a Home

You should be as practical as possible when considering the absolute "must-haves" in your future home. Although having that extra bathroom or a sprawling master suite is great, it might not fit your budget.

Create a prioritized list distinguishing between must-haves (number of bedrooms, maximum commute time) and nice-to-haves (pool, large yard, specific architectural style). This clarity will guide your search and help your real estate agent find properties that truly match your vision.

There are many different options to consider when purchasing a home, so hopefully, this brief list will be helpful when making those decisions:

Home Logistics

Do you want a home with multiple acres and plenty of land? Or, are you comfortable with something on less than an acre and close to neighbors? Is a driveway a must-have? Do you prefer a condominium apartment over a house?

Location Preferences

Location is the most important part of buying a home. Consider proximity to Research Triangle Park, downtown Raleigh, or other employment centers.

Do you want a historic home in downtown Raleigh, a suburban family neighborhood, or rural property in the Piedmont region?

Size and Floorplan Layout

How many bedrooms do you need? How many baths? Is a finished basement a must? Do you want the whole home on one level or multiple levels?

School Districts

North Carolina has excellent public school options in areas like Wake County and Chapel Hill-Carrboro

2. Get Pre-Approved For a Mortgage

Please note that getting pre-approved is not the same as getting pre-qualified. Pre-approval is a fairly easy process and will tell you exactly how much house you can afford based on your income, expenses, and more.

Pre-approval carefully reviews your credit and is far more thorough than pre-qualification, which only estimates how much you can afford. This will set you up for home-buying success.

Mortgage pre-approval is crucial in North Carolina's competitive market, especially in high-demand areas like the Triangle region. Pre-approval shows sellers you're a serious buyer and gives you a clear budget framework.

North Carolina-specific mortgage considerations:

- First-time homebuyer programs: NC Housing Finance Agency offers down payment assistance and favorable loan terms

- USDA Rural Development loans: Available for properties in designated rural areas throughout North Carolina

- VA loans: North Carolina has a significant military population near Fort Bragg, Camp Lejeune, and other installations

- Flood zone considerations: Coastal and some inland properties may require flood insurance, affecting your total monthly payment

Gather necessary documents including tax returns, pay stubs, bank statements, and debt information. Shop around with multiple lenders to compare rates and terms, as even small differences can save thousands over the life of your loan.

3. Hire a Full-Service Real Estate Agent

In North Carolina's diverse real estate market, having an experienced local agent is invaluable. A full-service agent provides comprehensive support throughout your buying journey.

The best part about being a buyer is that working with a real estate agent won't cost you anything. On average, the seller typically pays the real estate commission, totaling 5% or 6% of the home's sale price.

Speak with friends and family and conduct thorough research before contacting a potential real estate agent. Read their online reviews, check the content on their website and social media profiles, and ensure that your values align before taking this important step.

You will spend a lot of time with your agent touring homes over the next few months and working through negotiations, so you want to ensure that you hire someone you trust and work well with.

It is perfectly acceptable to interview more than one agent before deciding who to hire. Ask lots of questions during the interviews and take the time after your meeting to reflect, speak with someone close to you, and decide whether or not you want to move forward with that agent.

Your agent should understand North Carolina's unique market conditions, including seasonal trends, new construction patterns in growing areas like Cary and Apex, and the impact of the Research Triangle's tech industry on housing demand.

4. Search For a Home

With your criteria established and financing in place, the exciting search phase begins. North Carolina offers incredible diversity in housing options across different regions and price points.

Effective home search strategies:

- Neighborhood exploration: Drive through areas at different times of day and week to get a feel for the community

- Open houses and private showings: Experience properties in person to assess condition, layout, and neighborhood context

- New construction options: Consider builders in developing areas like Morrisville, Fuquay-Varina, and Wendell

Keep detailed notes and photos of properties you visit. North Carolina's varied geography means you might be comparing mountain properties with coastal homes or urban condos with suburban houses, so systematic evaluation is essential.

5. Make an Offer

When you find the right property, crafting a competitive offer is crucial. North Carolina's market conditions vary significantly by location and price range, requiring strategic approach.

Before putting in an offer on the home, your real estate agent will conduct thorough research on other homes that have closed in the neighborhood. If the home you wish to purchase is listed for $250,000, but most of the homes in the area that are similar in size recently sold for $220,000, you will probably want to put in an offer closer to $220,000.

Key components of a strong offer in North Carolina:

- Competitive pricing: Your agent will provide comparative market analysis based on recent sales

- Earnest money: Typically 1-3% of purchase price, held in escrow to demonstrate serious intent

- Contingencies: Include inspection, appraisal, and financing contingencies for protection

- Timeline considerations: Standard contracts allow 10-14 days for due diligence in North Carolina

6. Begin Negotiations

Negotiation is an art that requires understanding both market conditions and human psychology. Your real estate agent will guide you through this process, but understanding the basics helps you make informed decisions.

Negotiating a deal can sometimes take several days (or longer) until all parties agree. Be polite and courteous to your agent, the seller's agents, and the sellers, and remember that your agent has your best interest at heart. Once you are under contract, here are the next steps.

7. Schedule Home Inspection

After accepting the offer, it's time to schedule the home and pest inspections. Unless negotiated otherwise, the cost of these inspections will be your responsibility as the buyer.

North Carolina law provides buyers with a due diligence period (typically 10-14 days) to thoroughly evaluate the property. Professional home inspection is crucial during this time.

It is also very important to schedule the home inspection before scheduling the home appraisal (which differs from the inspection) and obtaining mortgage pre-approval.

A home inspection carefully reviews the home and searches for any defects. An inspector will review the electrical, plumbing, roof, overall structure of the home, and more to ensure that there aren't any problems.

If all goes well and there aren't any major issues, you are ready to obtain mortgage approval. However, if the home inspection report comes back and there are more problems with the home than you anticipated, you can back out of the deal.

North Carolina-specific inspection considerations:

- Termite inspection: Required by most lenders due to the state's climate

- Foundation issues: Clay soil in many areas can cause foundation problems

- HVAC systems: Critical given North Carolina's hot, humid summers and variable winters

- Electrical and plumbing: Older homes may need updates to meet current codes

- Radon testing: Recommended in certain geographic areas

- Septic system inspection: For rural properties not connected to municipal sewer

8. Obtain a Mortgage

If all goes well at the inspection and you don't find any major problems in the home you wish to buy, it is now time to obtain a mortgage. You will meet with a mortgage lender to discuss the available loan options and assess which makes the most sense.

If you have a credit score of at least 620, decent income, and can afford a larger down payment, you will most likely qualify for a conventional mortgage. Home buyers with lower credit, a small down payment, and limited income may qualify for a government loan.

A lender will almost always require a property appraisal when approving a home loan. This process typically involves examining recent home sales in the area (otherwise known as "comparables") and comparing the sale prices to the home you wish to buy.

Key mortgage milestones:

- Formal application: Submit complete financial documentation to your chosen lender

- Property appraisal: Lender orders professional appraisal to confirm property value

- Underwriting process: Lender reviews all documentation and makes final approval decision

- Lock interest rate: Secure your rate to protect against market fluctuations

- Final loan approval: Receive clear-to-close designation

Stay in close communication with your lender throughout this process. Avoid making major financial changes (new credit cards, large purchases, job changes) that could affect your loan approval.

9. Obtain Title Insurance

Title insurance protects your ownership rights and is typically required by lenders in North Carolina. This step involves researching the property's ownership history and ensuring clear title transfer.

North Carolina follows attorney-supervised closings in most counties, so your closing attorney will typically handle title insurance coordination and address any issues that arise.

Understanding title insurance in North Carolina:

- Title search: Professional examination of public records to verify ownership history

- Title commitment: Document outlining coverage and any exceptions

- Owner's policy: Protects buyer's equity interest (optional but recommended)

- Lender's policy: Protects mortgage lender's interest (required)

- Common issues: Liens, easements, boundary disputes, or inheritance complications

10. Final Walk-Through

The final walk-through occurs 24-48 hours before closing and serves as your last opportunity to verify the property's condition before taking ownership.

Final walk-through checklist:

- Verify agreed-upon repairs: Ensure all negotiated fixes have been completed properly

- Test all systems: Check HVAC, electrical, plumbing, and appliances

- Confirm included items: Verify that negotiated personal property remains

- Document any issues: Take photos of any new problems or concerns

- Utilities and services: Ensure electricity, water, gas, and other services are functional

If significant issues are discovered during the final walk-through, address them immediately with your real estate agent. Minor issues might be resolved with closing credits, while major problems may require delaying closing.

11. Closing on Your Home

Closing day is the culmination of your home buying journey. In North Carolina, closings are typically conducted by attorneys and involve signing numerous documents and transferring funds.

North Carolina closing process:

- Document review: Attorney explains key documents including deed, mortgage note, and settlement statement

- Fund verification: Bring certified funds for down payment and closing costs

- Final signatures: Sign mortgage documents, deed, and other required paperwork

- Key transfer: Receive keys and official ownership of your new home

- Recording: Documents are filed with county register of deeds

Methodology

Data was sourced by US Bank and Investopedia to help determine the top steps in the North Carolina home buying process.

FAQs

What should I expect at the closing?

You (or your mortgage lender) will provide a check for the amount that is owed on the home. The seller will then sign the deed, officially transferring ownership to you as the buyer.

Can I move into my new home directly after the closing?

Your contract will specify the exact date you can move in after closing. In some situations, you will receive the keys at the closing table and will be able to move in immediately. In other situations, the seller may request 30, 45, or 60 days of occupancy after closing on the home.

Who pays transfer tax in North Carolina?

The seller typically pays the transfer tax. When the ownership is transferred in the state of North Carolina, a tax of $1 per $500 is imposed on the property. So, the seller would pay a transfer tax of $600 on the sale of a $300,000 home.

How much time should I expect to spend at the closing?

A standard closing typically takes about one to two hours if both buyer and seller agree. However, if problems arise during the closing, it can take several hours to complete, depending on the situation.

North Carolina Home Buying Process - Final Thoughts

Buying a home in North Carolina involves navigating state-specific regulations, local market conditions, and regional considerations that can significantly impact your experience.

Whether you're drawn to the bustling energy of downtown Raleigh, the family-friendly communities of Cary, or the natural beauty of North Carolina's rural areas, we're here to help you find and secure your ideal home.

Ready to begin your North Carolina home buying journey? Contact Raleigh Realty today to connect with one of our experienced agents and take the first step toward homeownership.